Highlights for cattle

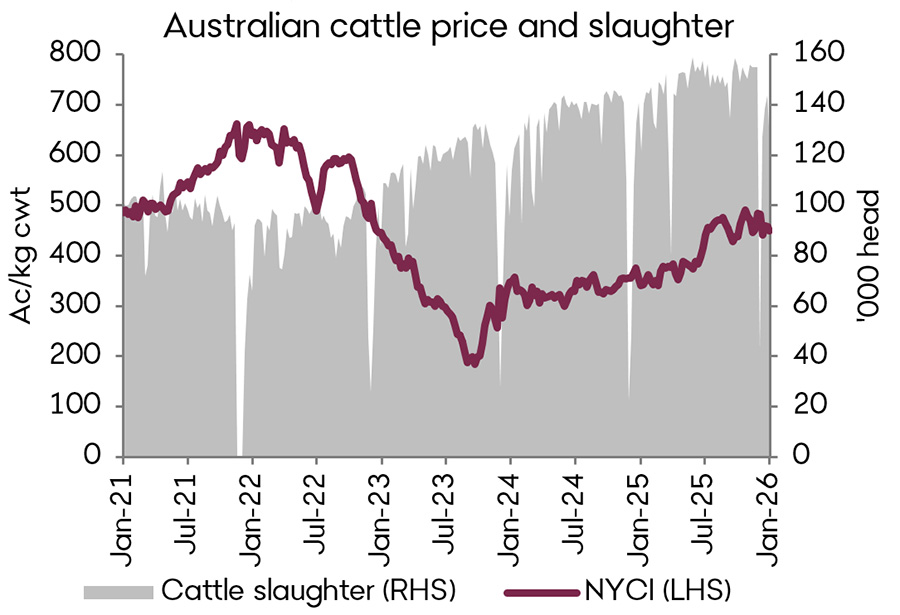

- Australian cattle prices have begun 2026 with a decline, falling from recent highs in the back end of 2025. The National Young Cattle Indicator currently sits at 447c/kg, which is a fall of seven and a half per cent since the first week of the year. Despite this decline, when compared to historical averages, the National Young Cattle Indicator is two and a half per cent above the five-year average and 19 per cent above the ten-year average. The reason for this decline in cattle prices was an abundance of supply following recent extreme weather events. The floods and fire damage has wreaked havoc on local producers, destroying machinery, fences and pasture, as a result of this many producers have been looking to sell. This influx of cattle without the demand to match from processing centres and re-stockers has left prices waning over the last few weeks. Processing centres are reported to be booked out until the last week of February, and those who are filling in the gaps are offering lower prices at saleyards. Cattle prices are expected to continue softening throughout February as the market begins to recover from the weather events and supply outweighs demand.

- The export story was much more positive. National beef export volumes sailed to a new January record, finishing the month at 84,343 tonnes. In comparison to 2025, this is four per cent higher than last year, it is also 20 per cent above the five-year average. Australian beef remains in high demand on the international markets with several major buyers of Aussie beef seeing solid rises when compared to a year ago.

Tom Herbert

Tom combines his agricultural degree with strong industry knowledge to provide commentary on local and international beef and cattle market trends.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.