Highlights for cropping

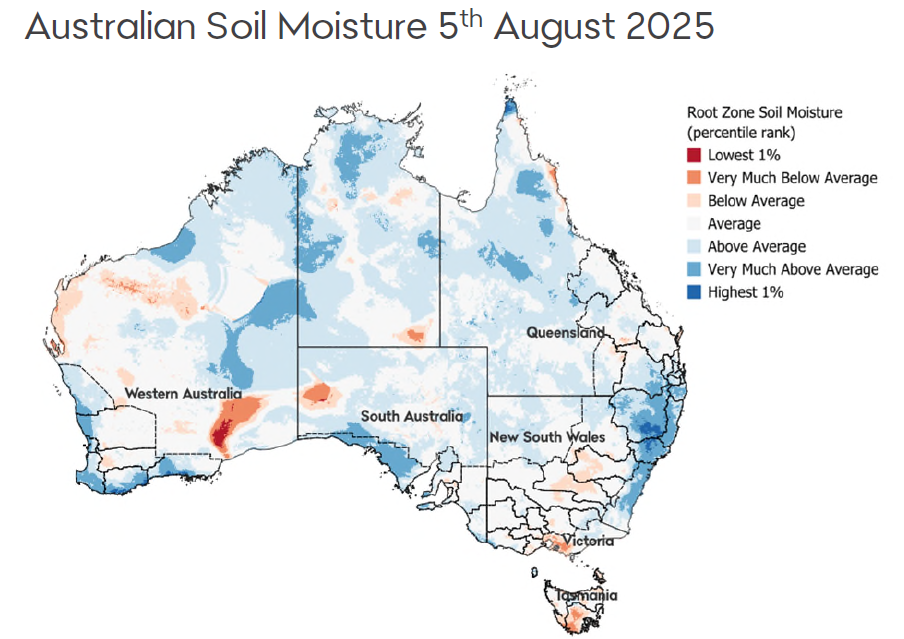

- Australia’s grain markets have softened over the past month as favourable seasonal conditions build and global harvest pressure intensifies. The standout shift has come in Victoria and South Australia, where late July rainfall provided a timely moisture boost following a delayed and dry start. Crop confidence has lifted nationally, but a kind spring will still be needed to deliver on potential.

- Wheat prices have eased in response. Spot CBOT futures are down nearly 7 per cent, with Western Australian values following suit. East coast prices have slipped around 2 per cent, underpinned by limited grower engagement and low liquidity. Despite the pullback, domestic wheat is still trading at a strong basis to international benchmarks, particularly in southern regions.

- Barley continues to outperform wheat, supported by steady feedlot demand and tightening old crop supply. Recent rainfall has sparked early grower interest in the new crop, though confidence in yield potential will determine forward selling activity through spring.

- Canola values have also dipped slightly but remain historically strong, with prices tracking near decile 8. Renewed export potential into China could offer further upside.

- With production conditions stabilising and global grain flows remaining heavy, the market tone has shifted decisively. This month’s update explores the evolving pricing dynamics across wheat, barley, and canola - and the key watch points shaping the outlook into spring.

Rod Baker

Rod is our Insights specialist for the cropping industry, combining a diverse agricultural background with an Environmental Science degree to deliver expert commentary on commodity markets and trends.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.