Highlights for cropping

- Australia’s grain market sits at a crossroads, with key weather systems expected to shape national pricing in the weeks ahead. Domestic grain prices—especially for barley—remain elevated, driven by strong feed demand and dry conditions in Victoria and South Australia.

- While recent rains brought some relief to parts of New South Wales and Western Australia, southern regions continue to face dry conditions and tight supply. Forecasters now predict 15–50mm of rain for Victoria and South Australia by mid-June. This eight-day window could prove decisive for crop outlooks and market sentiment.

- Globally, the wheat market shows limited conviction. The U.S. crop outlook has improved, but Russia, China, and parts of Europe still face weather-related risks. Notably, the EU raised its wheat production estimate by 13 per cent year-on-year, adding bearish pressure. Yet, with the northern harvest nearing, buyers remain cautious.

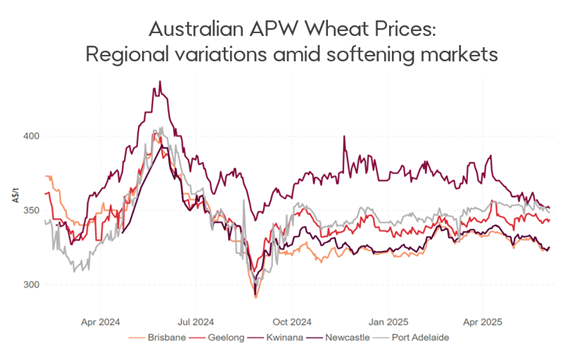

- Wheat prices in Queensland, New South Wales, and Western Australia have dropped. This is due to better conditions and lower export demand. Grain is flowing back into domestic markets as exporters pull back and draw down existing stocks. South Australia and Victoria have kept prices steady, even with feed shortages. This is partly due to a steady supply from southern New South Wales.

- As winter sets in, all eyes are on the skies. The coming week could reset both the forecast and the price board.

Rod Baker

Rod is our Insights specialist for the cropping industry, combining a diverse agricultural background with an Environmental Science degree to deliver expert commentary on commodity markets and trends.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.