Highlights for cropping

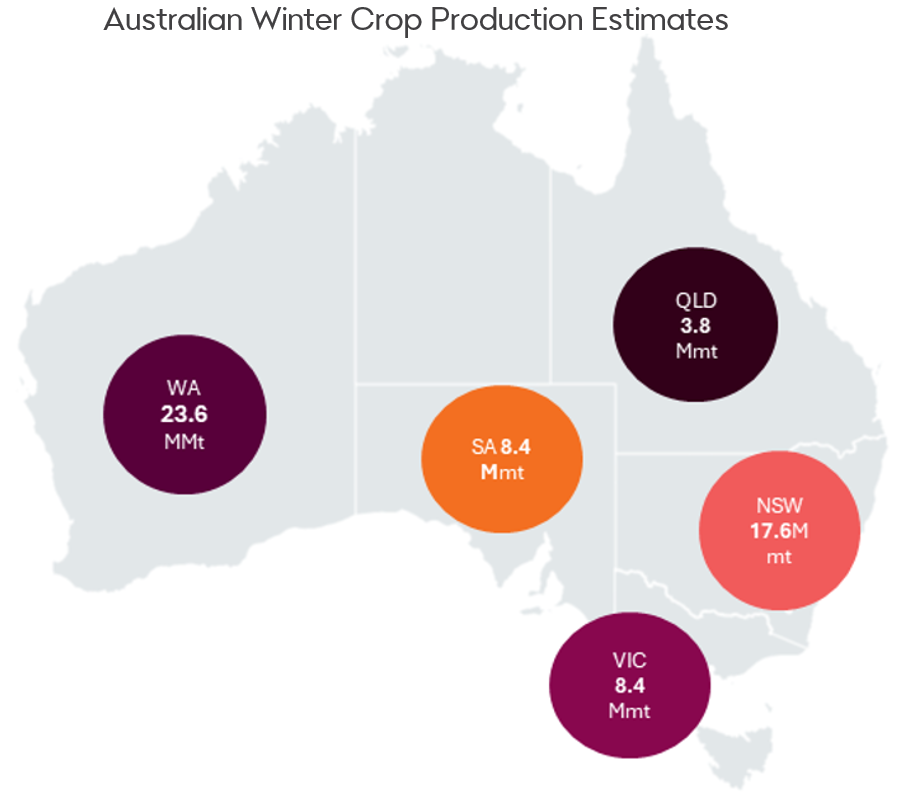

- Bendigo Bank Agri Insights has lifted Australia’s 2025/26 winter crop production estimate by 1.2 per cent to 61.8Mmt, marking the third-largest winter crop on record. The increase was largely driven by Western Australia, where a soft finish has seen crops fill under mostly ideal conditions. The state is poised to deliver its fourth 20Mmt-plus harvest in the past five years. This may now represent the “new normal”, shaped by the structural shift away from sheep following the live export ban, and supported by ongoing advances in agronomy and soil management.

- The impact of recent rain across southern Australia-which lifted yield prospects for later-sown crops through Victoria’s southern regions and South Australia’s South East – will only be confirmed through actual delivery data. At a state level, the effect appears stabilising rather than yield-enhancing, helping crops hold potential after a dry September.

- Harvest momentum continues to build across Australia, though progress remains behind last year’s pace, with 3.8 million tonnes delivered so far compared with 5.7 million tonnes at the same stage in 2024. Rain interruptions and a cool finish across southern regions have slowed operations. The wet conditions are expected to ease over the coming week, allowing growers to ramp up operations. As conditions improve, attention will shift to how quickly new-season grain flows to market and whether current price support holds once harvest pressure intensifies. Feed grains remain the most exposed to downside risk as grower selling accelerates through November, while higher quality wheat is likely to draw firm export demand, preserving grade spreads despite increased volume.

Rod Baker

Rod is our Insights specialist for the cropping industry, combining a diverse agricultural background with an Environmental Science degree to deliver expert commentary on commodity markets and trends.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.