Highlights for cropping

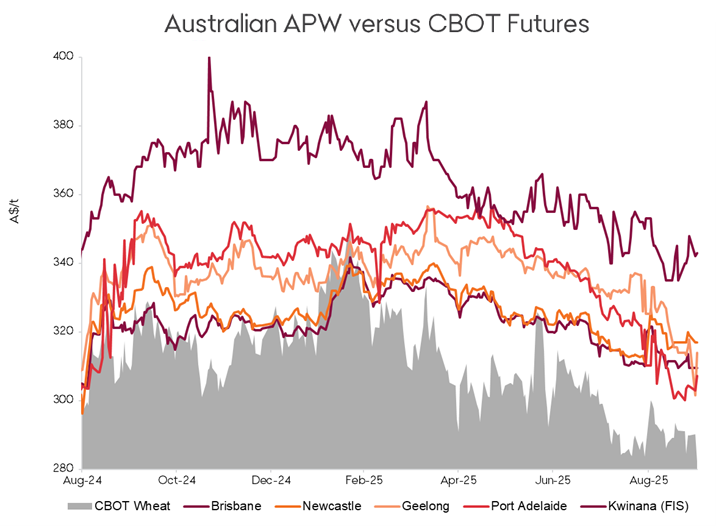

- Australian grain markets have been under sustained downward pressure since April, with wheat prices declining across all states through winter and into spring. The chart on the right illustrates the bearish trajectory, driven by ample global supply, imminent Northern Hemisphere harvest pressure, and a heavily oversupplied international market that continues to cap any meaningful upside.

- Local wheat values have found modest support over the past fortnight through a weakening Australian dollar and ongoing grower reluctance to commit forward sales at current price levels. However, these are short-term influences. With CBOT wheat futures declining (down 2.4 per cent over the past week) and abundant global supply anchoring the market, Australian wheat remains poorly positioned in export markets despite improved relative competitiveness.

- Canola has tracked the broader weakness in international oilseed markets, with WA new crop values falling from around $900/t in late June to $796/t as of October 1st. ICE canola dropped 2.9% over the past week, while the EU's rebounding rapeseed crop (up 21% to 21.6Mt) has added supply pressure. However, canola remains relatively well-positioned compared to cereals. Reports that China has purchased 500kt of Australian canola for November-January delivery should provide price support through harvest, making new crop canola sales worth considering before further downward movement materializes.

Rod Baker

Rod is our Insights specialist for the cropping industry, combining a diverse agricultural background with an Environmental Science degree to deliver expert commentary on commodity markets and trends.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.