Highlights for dairy

-

While the December to January period is typically uneventful for dairy markets, this year has been marked by continued global uncertainty and some market shifts. Geopolitical events, including US actions in Venezuela, renewed US-Europe tensions, and new Chinese tariffs on select EU dairy products, are creating an unpredictable trade environment.

-

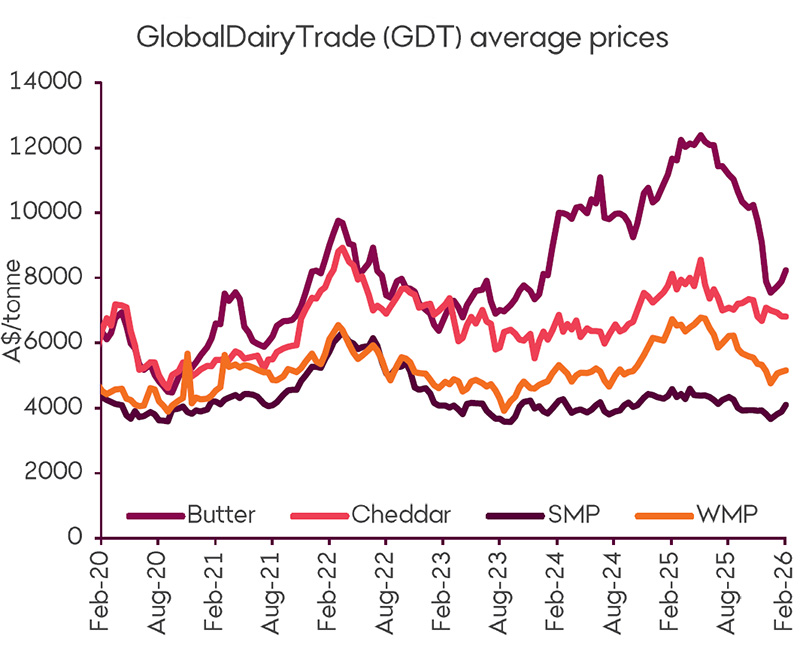

On the global stage, a run of price declines on the GlobalDairyTrade platform has halted, with prices expected to increase in the coming months as New Zealand's seasonal volumes tighten and buyers replenish stocks. However, this is set against a backdrop of robust and increasing milk production worldwide. The US reached a historical high in 2025, and both Europe and New Zealand have seen consistent growth. This abundance of milk may limit long-term price support, although concerns about supply chain disruptions if further geopolitical conflict eventuates could encourage short-term stockpiling.

-

In Australia, milk production saw its first increase in nine months this December, rising by 1.8 per cent year-on-year, primarily driven by a favourable end to spring in some southern regions. However, significant challenges persist, including smaller herds in some areas, water constraints from dry conditions, and high irrigation costs. While some states like NSW, Queensland, and Tasmania show milk production growth, the largest producing state, Victoria, remains down for the season to date, as do South Australia and Western Australia.

-

Despite the recent uptick, the Australian milk pool is still project to end 2025/26 one to two per cent below the previous season.

Eliza Redfern

After studying Agriculture at Melbourne University, Eliza worked in corporate dairying across southeast South Australia and Victoria, before moving to Dairy Australia where she managed the Analysis and Insights portfolio. She now manages the Agri-Insights business for the bank and remains an expert in dairy market analysis.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.