Highlights for dairy

- As Australia’s milk production nears its seasonal peak, volumes are gaining ground after a challenging start to the season. Nationally, milk intakes for September were down 0.4 per cent compared to the same month in 2024, bringing the year-to-date decrease to 2.3 per cent, compared with 3.4 per cent to August.

- New South Wales and Queensland both posted gains for September, though their respective pace is slowing as the season develops. Tasmania leads the pack, as recovery from a very ordinary 2024/25 gains pace amidst better seasonal conditions. Conversely, milk volumes are trailing last season in Victoria, Western Australia and particularly South Australia.

- All three have seen improvements as spring gets underway, but whether this is the beginning of a sustained recovery remains to be seen. Easing grain prices and recent reports of crops being cut for hay will be welcome developments for dairy farmers, however feed will remain the key risk weighing on many decisions in the coming months.

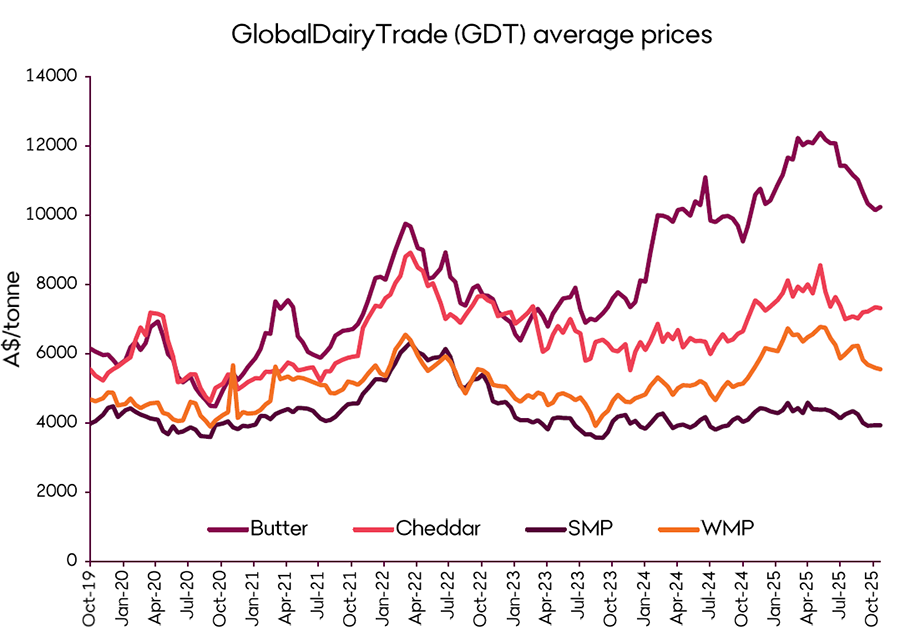

- Australia’s relative recovery in milk production risks being drowned out by growth in the United States, Europe and New Zealand. With European and US dairy commodity indicators in freefall, competitive pressure is likely to continue building as values dip below Australian and New Zealand equivalents. Add in growing NZ production as their season ramps up, and it's difficult to see much upside for global dairy markets in the short term.

- Despite relatively conservative 2025/26 opening farmgate milk prices, the likely downside flowing through commodity markets means any increases to farmgate offers will more likely be driven by competitive dynamics and the need to support farmers, particularly if conditions dry up later in spring.

John Droppert

John can’t help but get involved in our dairy coverage, having spent over 15 years analysing the sector in one form or another including over a decade at the industry’s Research and Development Corporation, Dairy Australia. Prior to that, he grew up on a dairy farm in the Macalister Irrigation District of Gippsland, Victoria.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.