Highlights for dairy

- Australian milk production in the first two months of the new season is already 3.4 per cent below last season. This isn’t a surprise given trying seasonal conditions in southern dairy regions and a reduced herd. While the outlook suggests a wet spring ahead, feed shortages will likely persist through the peak production period. Even with grain harvest coming up and improved pasture growth should climatic conditions improve, production will face an uphill battle to exceed last season given reduced herd numbers. Our initial production estimate for the 2025/26 season was a range of 8.2-8.1 billion litres. With a slow start to the season it’s looking likely to be at the lower end of that range.

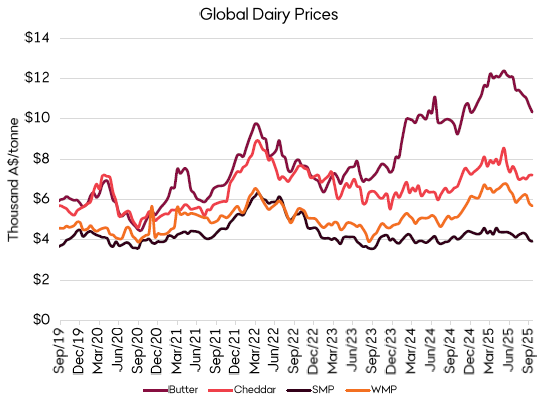

- US milk production continues to improve after a period of stagnation. The US dairy herd is expanding, and at 9.08 million head is the largest herd in close to 30 years. Milk output is lifting as a result, which is having an impact on both US and global dairy pricing. US Class III milk futures fell below US$17 for the first time in over a year, and forward contracts point towards lower prices as production improves.

- Lactalis has been confirmed as the winning bidder for Fonterra’s Australian assets in a $3.46 billion deal. While the deal is not completely finalised – shareholders will vote on the proposal this month – the sale is expected to be cleared without issue. The response from the Australian dairy industry has been mixed with many expressing concerns about Lactalis’ intentions, particularly with regard to manufacturing facilities. Fonterra claims it will be ‘business as usual for their suppliers, but Lactalis has remained tight-lipped as to their future plans for Fonterra’s assets in the Australian market.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.