Highlights for horticulture

- Trade is continuing to adapt to the market uncertainty and volatility driven by US tariffs. This is likely to result in greater competition across fruit markets as Southern Hemisphere exporters in particular rush to diversify away from the US. South Africa is continuing to push ahead into new markets with South African stone fruit nearing market access into the Chinese market. While this may lead to some additional competition, we expect a strong quality advantage over South African product to continue to hold Australian exporters in good stead, particularly into the quality sensitive Chinese market.

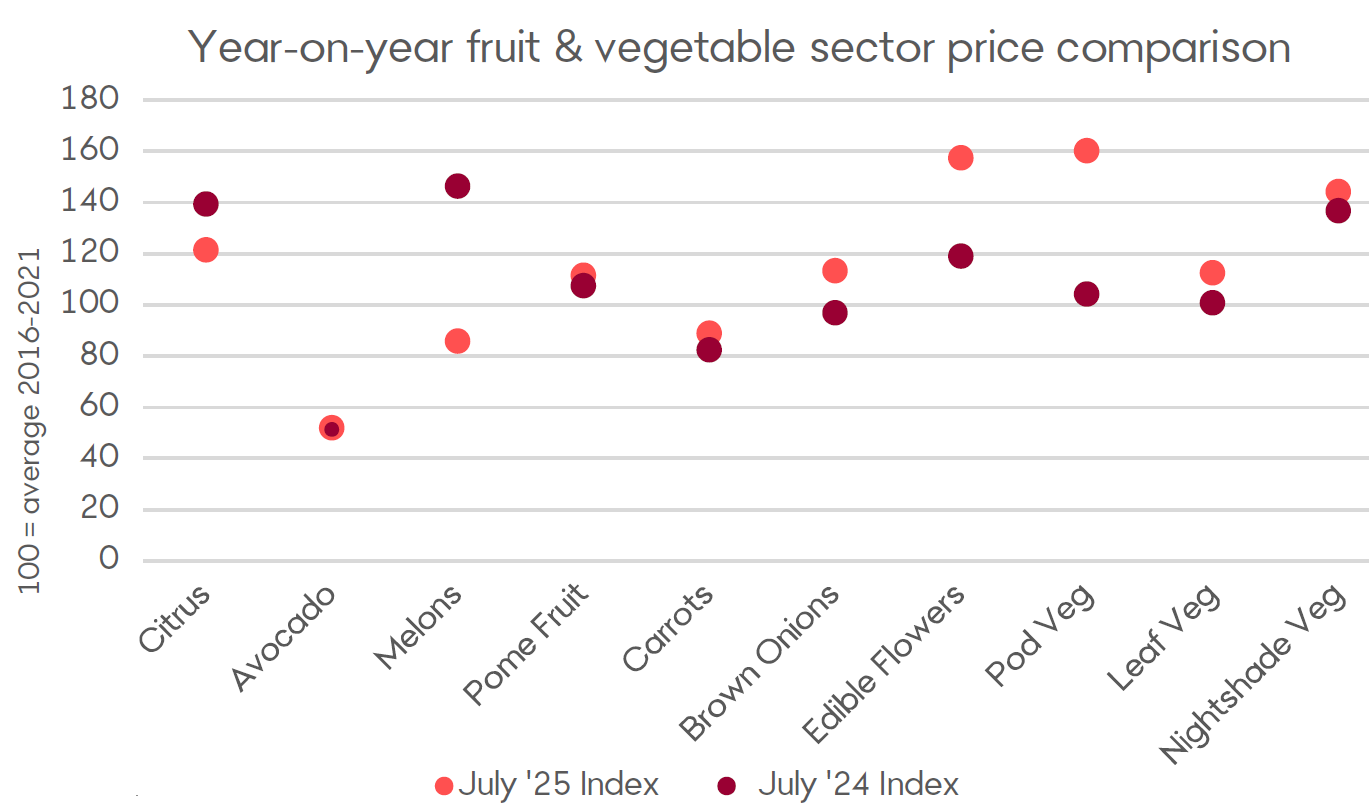

- Year-to-date Australian onion exports are at their lowest level since 2017. A challenging season for producers across both South Australia and Tasmania has limited the volumes of both brown and red varieties available for export. Meanwhile, greater export competition from India has further depressed onion exports in Asia through the first half of the year. Average brown onion pricing at a national level is sitting at $1.40kg, nine per cent higher year-on-year. Red onions, meanwhile, are 28 per cent higher on average.

- An unpredictable geopolitical environment, mixed seasonal conditions and shifts in labour availability have seen an increase in price volatility across a range of key horticultural inputs over recent months. Urea demand has lifted above prior expectations amidst improving seasonal conditions in South Australia and Victoria. Meanwhile temporary allocation water markets remain substantially higher year on year with water storages across the Southern Basin just 63 per cent full.

Sean Hickey

Sean is our Insights specialist for the horticulture sector, utilising both his time spent within the industry alongside a Bachelor of Commerce to produce informed market analysis and commentary.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.