Highlights for horticulture

-

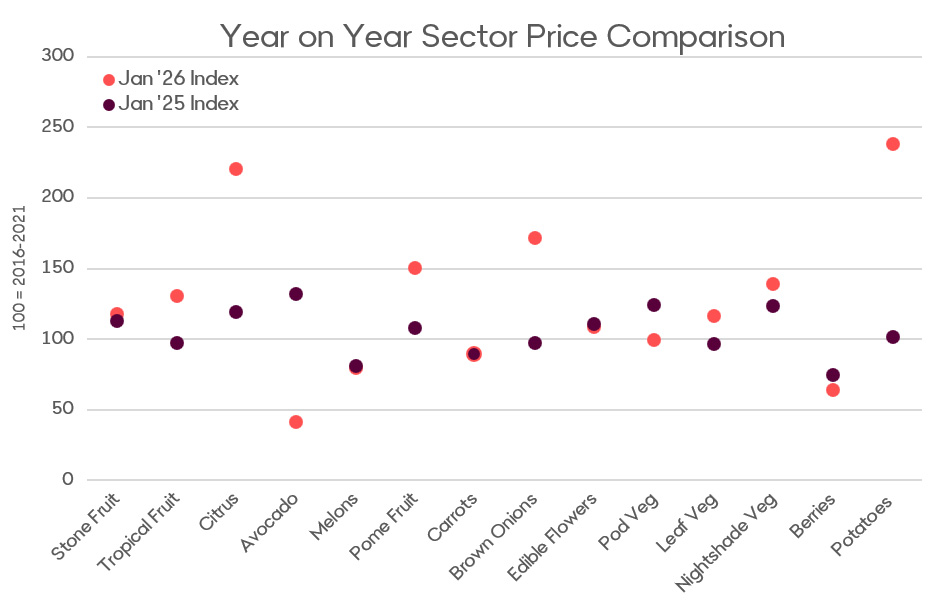

Bendigo Bank Agribusiness’ wholesale fruit and vegetable price indexes have diverged through the December and January period. From a vegetable perspective, the limited availability of brown onions and potatoes across southern growing regions have driven the price index higher during the period. Meanwhile, our fruit price index came under supply pressure as seasonal volumes of stone fruit, table grapes and tropical fruit peaked, weighing on prices.

-

Looking ahead, almond growers are on track for a strong season with the Almond Board of Australia forecasting a crop of 166,892 tonnes. This is a seven per cent increase over the 2025 harvest and comes at a time when local stocks have been emptied out by significant export demand from India and China. Harvest is slowly kicking off and will be in full swing by mid-February with the hot and dry conditions in late January having little effect on yield expectations, though irrigation costs may impact margins. Export demand is anticipated to remain high throughout 2026 on the back of a smaller than expected crop in California.

-

Table grape harvest is now in full swing across southern areas, though growers are navigating challenges from recent heatwaves. High temperatures have affected some red and black varieties in particular by inhibiting colour development, impacting quality. Though overall quality of earlier red and most white grapes remained high in key regions like Sunraysia. From an export perspective Australia continues to establish a strong position in Vietnam, although the international market is becoming more competitive with the Peru sending strong volumes and China's own increasing domestic production finding a home in Vietnam. Demand may also come under some pressure owing to the resurgent Australian Dollar

Sean Hickey

Sean is our Insights specialist for the horticulture sector, utilising both his time spent within the industry alongside a Bachelor of Commerce to produce informed market analysis and commentary.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.