Highlights for horticulture

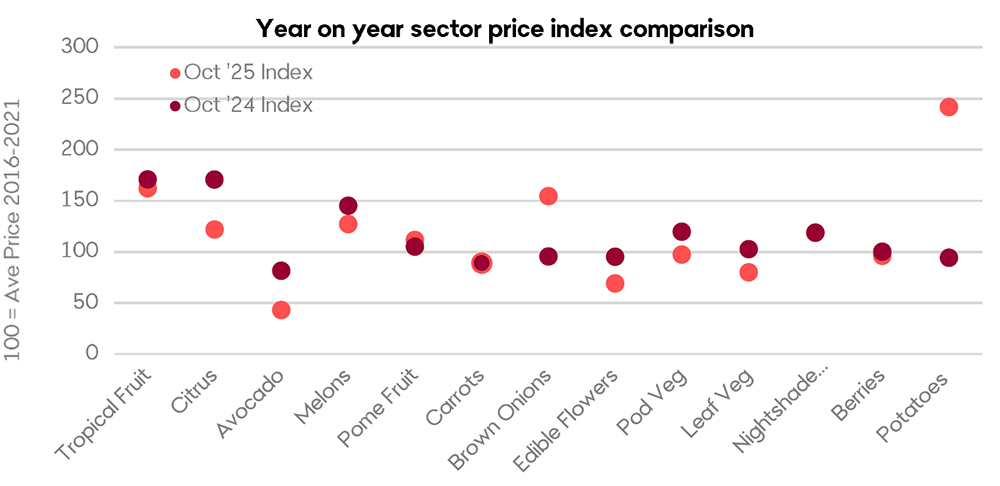

- Wholesale prices across most key fruit and vegetable sectors remain in line to slightly lower year on year with a couple of key exceptions. Both brown onion and potato prices are still sitting at a significant premium to 12 months ago. These outliers are a result of production and sizing issues out of South Australia, a key production region for both of these staple vegetables, following drought conditions seen across the first half of the year. November is expected to see supply of brown onions and potatoes stabilise as the harvest of spring crops begins to hit store shelves.

- Mangoes, berries and stonefruit are now becoming more abundant on store shelves, a key sign that the start of summer isn’t far off. Mango pricing has finally started to ease after a slow start to the season compared to prior years. Wholesale prices are currently around average with KP mangoes at a decile 5.7 with R2E2 mangoes a little more expensive at a decile 6.2. Prices should come under further pressure across November with supply out the Katherine and Kununurra at its peak and Queensland volumes picking up.

- Avocado pricing remains low with supply this season outpacing earlier industry forecasts, particularly across North Queensland and Western Australia. With an all time record Western Australian crop on the horizon, pricing should remain under pressure into 2026. The low prices will likely see annual domestic consumption per capita lift above 5kg per person for the first time. However, with production growth continuing to outpace domestic consumption increases, further expansion of export volumes will be required to ensure margins remain sustainable. The industry remains hopeful that negotiations between the Australian and Chinese governments will allow market access.

Sean Hickey

Sean is our Insights specialist for the horticulture sector, utilising both his time spent within the industry alongside a Bachelor of Commerce to produce informed market analysis and commentary.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.