Highlights for sheep

- Australian lamb prices have continued to strengthen over the past couple of months, with records seemingly being topped every few weeks. The National Trade Lamb Indicator (NTLI) has now exceeded 1,230 c/kg, marking a +14.9 per cent increase month-on-month, and is now trending +61.4 per cent above the five-year average.

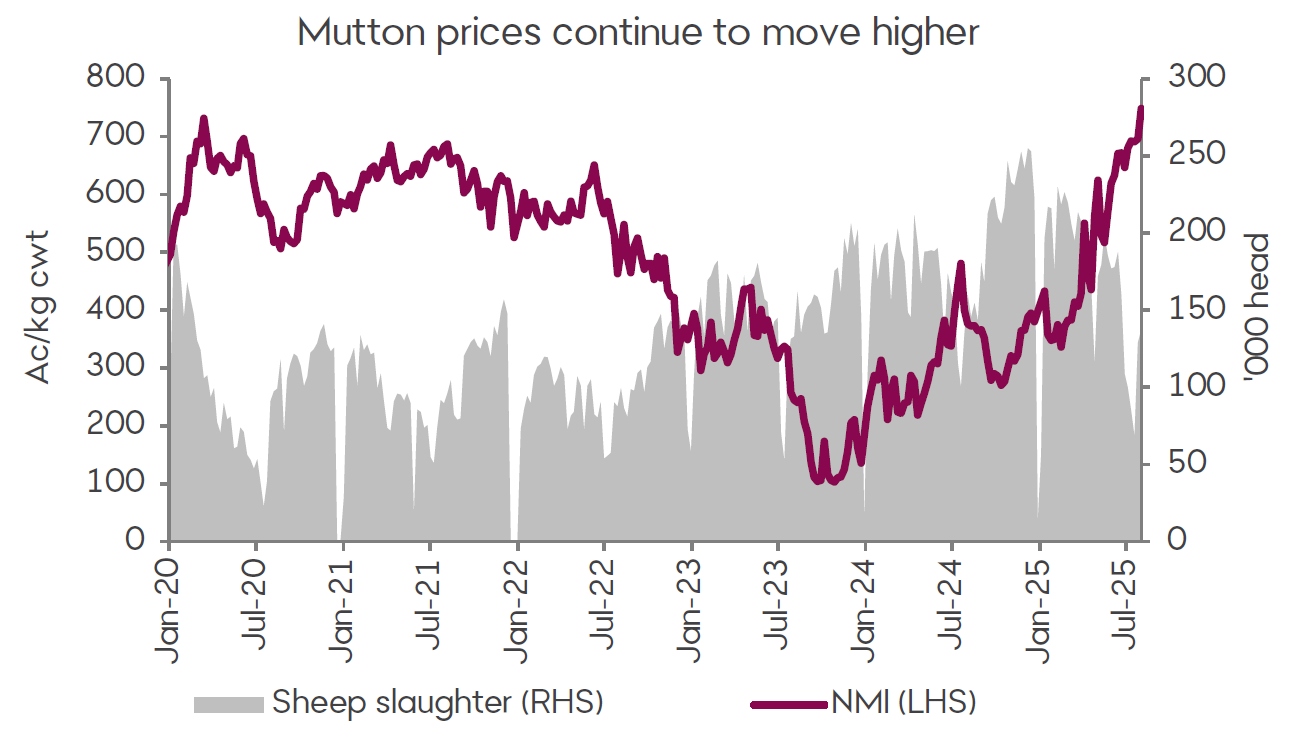

- Lamb processing rates have slowed throughout June and July, in part due to the winter slow down and processors undergoing winter maintenance, but also on the back of the tightening supply we are now seeing of both lamb and mutton. Lamb slaughter averaged almost 374 thousand head per week in July, down -16.3 per cent compared to July last year, and -25.5 per cent below the recent high in May. This tightening of supply has been a key driver of sheepmeat markets over the past two months.

- Lamb prices are forecast to be relatively steady throughout August, but prices are expected to face some downwards pressure as we move into spring, as new season lambs start to flow into markets. However, given the tough conditions in key producing regions across the southeast of the country, as well as the heightened turn off rates over the past 18 months, new season lamb supply is expected to be significantly lower this season. The recent rainfall is also expected to support grower confidence, and assuming conditions remain favourable, we may see producers begin rebuilding once pasture growth speeds up in spring. As result, lamb prices are expected to maintain a considerable premium compared to the five-year average.

Joe Boyle

Joe is our Insights specialist for the sheep industry. He hails from a cropping and sheep farm in northwestern Victoria and has studied a Bachelor of Agriculture at the University of Melbourne.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.