Highlights for sheep

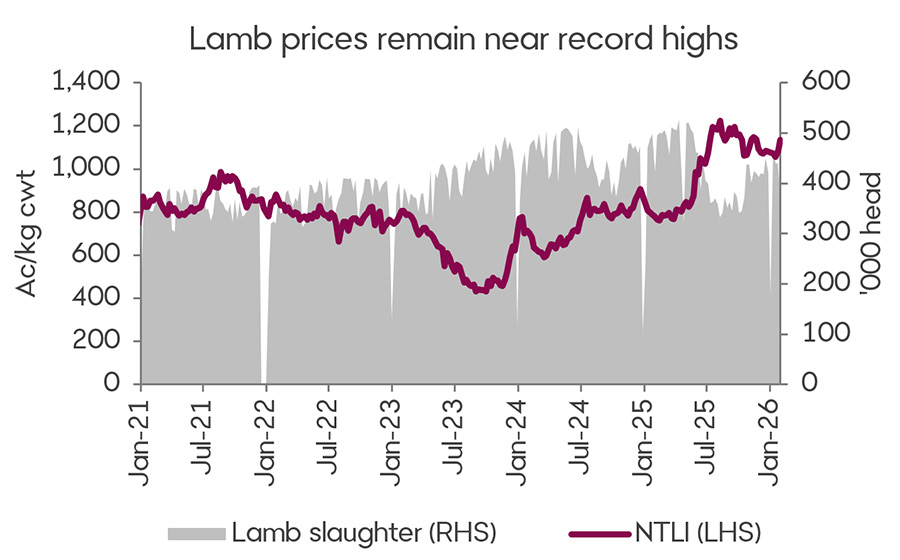

- Australian lamb prices have held firm to start the new year and moved higher throughout January, in what has been a challenging period for many across the country due to extreme heat, bushfires and floods. The National Trade Lamb Indicator finished the month at 1,136 c/kg, up 5.0 per cent from the start of the holiday break and 42.4 per cent above the five-year average.

- Tight supply continues to be the major driver of the market, with lamb yardings and processing rates trailing behind this time last year. Lamb yardings averaged 183 thousand head per week in January, down 32.2 per cent from December last year and 19.2 per cent lower than January 2025. Lamb slaughter averaged 376 thousand head per week for the month, approximately 45 thousand head lower compared to January in both 2024 and 2025.

- Hot and dry conditions have left soil moisture levels below to very-much-below average across most sheep producing areas, while long term rainfall outlooks are indicating drier conditions ahead across most southern regions. This is expected to limit restocking activity in the short-to-medium term, although comparatively cheap livestock feed prices will encourage growers to hold on to stock rather than turn-off further.

- Lamb prices are expected to remain elevated over the next few weeks until supply of finished lambs starts to pick up. However, should we see a favourable autumn break, restocking activity would see the market strengthen further.

Joe Boyle

Joe is our Insights specialist for the sheep industry. He hails from a cropping and sheep farm in northwestern Victoria and has studied a Bachelor of Agriculture at the University of Melbourne.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.