Highlights for wool

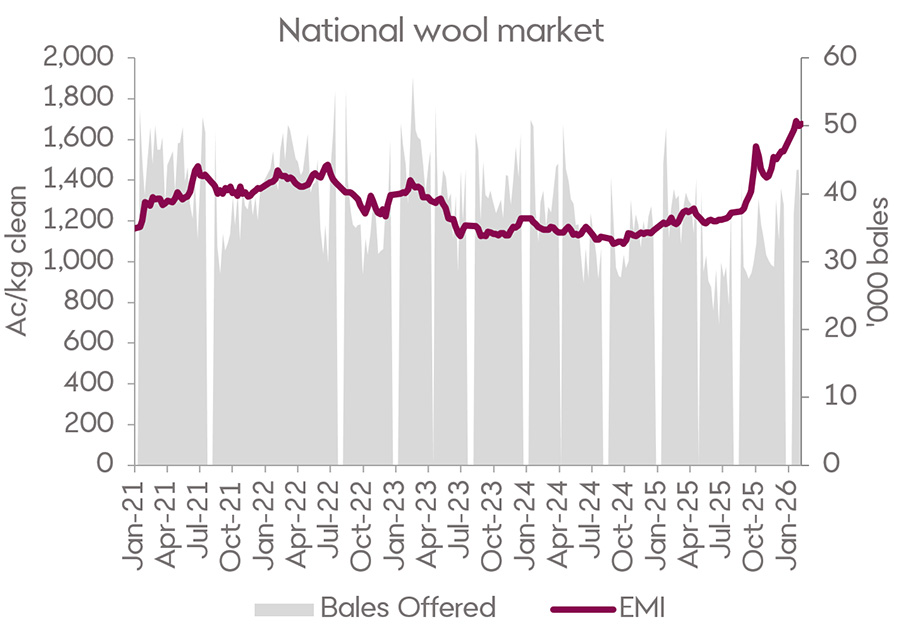

- The Australian wool market continued its positive run into 2026, moving higher in the first two selling weeks before unfavourable currency movements halted its progress. The AWEX Eastern Market Indicator (EMI) climbed 148 cents between the final selling week of 2025 and second last sale in January, before falling back -24 cents in the final selling week of the month. The Australian Dollar (AUD) has lifted sharply over the past few weeks, reaching above 70 USc to its highest point since February 2023. While the firmer AUD saw the EMI move lower in AUD terms, the EMI continued higher in US Dollar terms throughout the month.

- Wool supply lifted in January, with weekly offerings averaging 41.4 thousand head per week, up 10.6 per cent from December but still down -2.7 per cent compared to January 2025. The ongoing tighter supply of wool following destocking over the past few seasons continues to provide significant support to the market. The Australian Wool Production Forecasting Committee estimates that wool production will total 244.7 million kgs (greasy) in 2025/26, which will mark a -25.3 per cent decline from the recent peak in 2022/23.

- Prices have also been supported by improving consumer confidence in Australia’s key markets of China and Europe. However, ongoing uncertainty relating to global trade and inflationary concerns continue to limit upside. Wool prices are forecast to be steady to slightly firmer over the next few weeks, as the continued tighter supply will provide support, while the firmer Australian Dollar will limit gains.

Joe Boyle

Joe is our Insights specialist for the sheep industry. He hails from a cropping and sheep farm in northwestern Victoria and has studied a Bachelor of Agriculture at the University of Melbourne.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.