As the end of the financial year draws near, it’s time to bring Farm Management Deposits (FMDs) back into focus. Whether you’re wrapping up seeding, managing livestock or just trying to stay on top of cash flow, now is the time to be thinking of tax planning – and the FMD scheme remains one of the most effective tools for doing just that.

Why FMD’s Matter

Exclusive to Australian farmers, the FMD scheme allows eligible1 producers to shift pre-tax income – up to $800,000 – into a dedicated deposit account, which can be drawn on in tougher years. It’s a powerful way to smooth out the financial highs and lows that come with running a farm.

FMD Trends: What the Numbers Tell Us

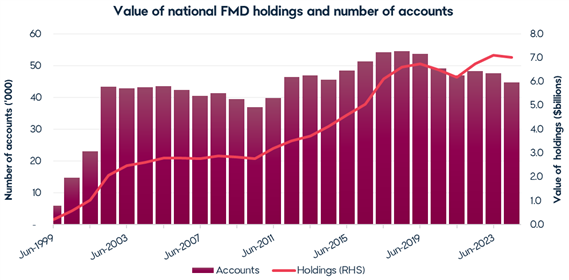

FMDs have become a cornerstone of farm financial planning since their launch in 1999. National holdings reached a record $7.11 billion in June 2023, bouncing back strongly after drought-related drawdowns

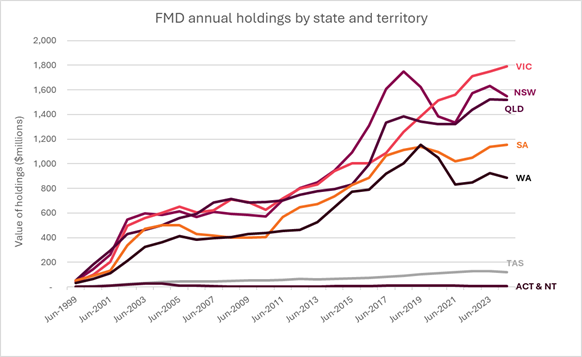

- Victoria has led the way, with 14 consecutive years of growth and a 185% increase since 2010.

- WA holdings are still 23% below their 2019 peak, despite strong productions years, suggesting a shift toward other risk strategies like asset upgrades or off farm investments.

- NSW and QLD saw earlier drawdowns, aligning with the start of the prolonged drought in 2018.

Industry Breakdown: Who’s Using FMD’s?

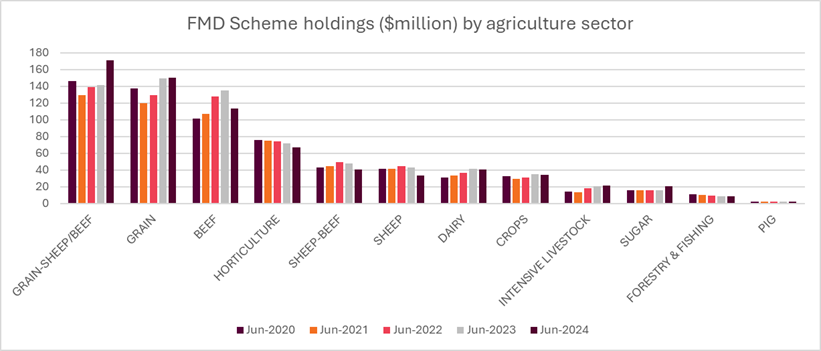

In 2024, mixed grain-sheep/beef farms held the largest share of FMD value at 24%, followed by grain (21%) and beef (16%). Sector-by-sector changes reveal how fortunes shift with seasons and markets:

- Sugar growers led the gains (+29%)

- Mixed Grain-sheep/beef enterprise were also strong (20%)

- Sheep and beef sectors saw the sharpest declines.

Final Word

EOFY is more than just tax time-it’s an opportunity to set your business up for the year ahead. FMDs are a proven tool to help build resilience, manage risk, and strengthen financial outcomes. Speak with your advisors early and contact Bendigo Bank Agribusiness to explore how a Farm Management Deposit can help strengthen your EOFY position.