Highlights for wool

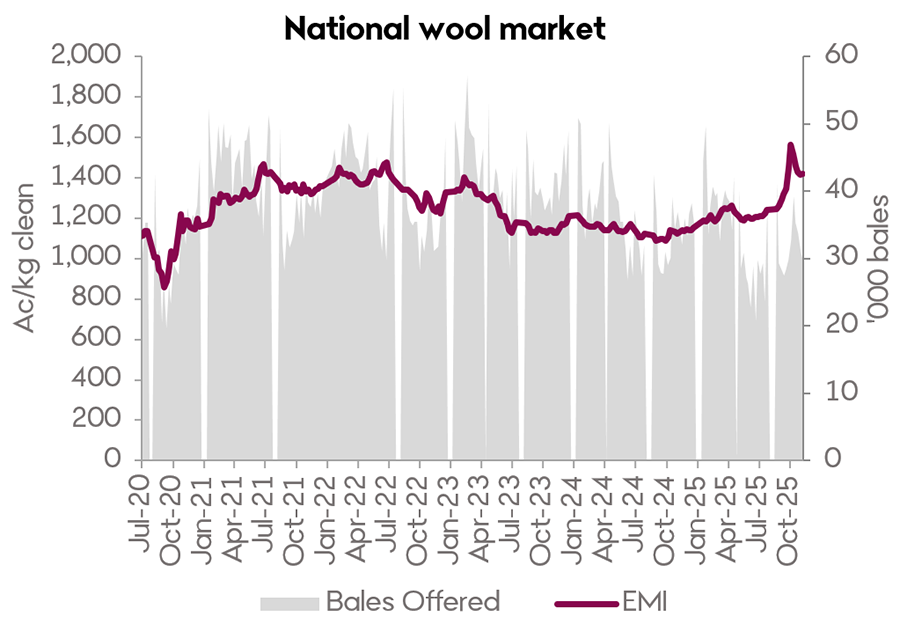

- The AWEX EMI is now sitting at 1,419 c/kg. While lower than the recent highs, this is still 25.4 per cent higher than the same time last year. With the Australian dollar having weakened in recent weeks, the EMI in USc terms has been fluctuating more recently, currently sitting at 924 USc/Kg. There had been concerns that a stronger Australian dollar may dampen sentiment and put downwards pressure on price, at this point of the year currency changes are having less impact on the price than in recent seasons, a good indicator the underlying market dynamics are coming to the fore.

- As a result of the premium prices on offer through the first 14 weeks of the season several bales have been brought out of stores leaving auction volumes almost on par with last year, only down by 4.2 per cent. However, testing figures show a 9.2 per cent decrease, year-on-year, reflecting a forecast drop in supply for this season, due to decreasing flock numbers, increasing input costs and seasonal challenges. As stored bale numbers decrease it will result in a decrease in week-to-week auction volumes as we moved forward through the remaining selling weeks in the season.

- One of the factors in the price declines in recent weeks has been the relative oversupply of fine Merino wool which has reduced the premiums on these MPGs. Crossbred wools are starting to find some support in recent weeks and with easing supply the merino MPGs are now finding support too.

Claire Adams

Claire is our Insights specialist for the wool industry. She combines her experience through government, industry and agriculture alongside a Masters in Global Food & Agricultural Business and a Bachelor of Environmental Science (Hons).

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.