“Cash earnings are lower this quarter, largely due to lower Other Income, while expenses were below the 1H25 quarterly average. Net interest income was slightly lower than the 1H25 quarterly average with net interest margin flat on the prior quarter. The balance sheet remains well positioned for the current economic outlook with more moderate levels of growth expected in the future.

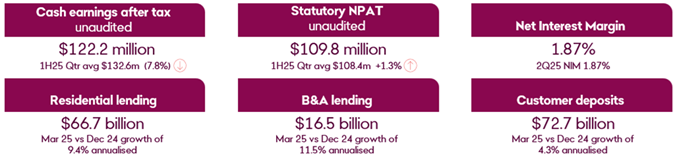

Residential mortgage growth slowed in the last month of the quarter, with the quarterly growth now below 10% annualised. Deposit growth was steady over the quarter, with transaction accounts declining, while savings accounts (excluding offsets) grew 9.3% annualised on the prior quarter. Business lending growth was driven by Portfolio Funding growth over the quarter.

During the quarter we migrated the Rural Bank system and retired the Rural Bank brand, as we deliver the final phase of our six-year transformation program. We have continued to reduce the number of core banking systems from eight to two, further simplifying our business and technology platforms.

We remain focussed on sustainable growth and productivity improvements as we scale the business.”

- Richard Fennell, Managing Director and CEO

Financial performance for 3Q25

- Unaudited cash earnings of $122.2 million, down 7.8% on 1H25 quarterly average. Unaudited statutory NPAT of $109.8 million in the quarter.

- Net Interest Margin was flat on 2Q25, with the benefit of repricing activity offsetting the impact of a lower cash rate.

- Net interest income was slightly lower over the quarter reflecting fewer business days, stable margin and 7.4% annualised growth in average interest earning assets.

- Other Income was down 13.6% driven by lower completions in Homesafe and lower account keeping fees.

- Operating expenses were 1.2% lower than the 1H25 quarterly average, due to:

- Slightly higher investment spend (in line with previous guidance); and,

- Lower BAU costs reflecting reduced staff costs.

- Credit expenses were $1.9 million for the quarter, with lower collective provisions partly offset by higher specific provisions in Consumer.

- Balance sheet remains well positioned to meet our growth targets, with a customer deposit funding ratio1 of 77%, a quarterly average LCR of 134%, and monthly NSFR of 117%.

- CET1 ratio of 10.83% was down 34bps on the prior quarter, reflecting the payment of 1H25 dividend and regulatory adjustments.

Financial summary for 3Q25

| 3Q25 | 1H25 Qtr Avg. |

Movement 1H25 Qtr Avg. |

|

| Net interest income | 416.2 | 417.3 | (0.3%) |

| Other income | 59.5 | 68.9 | (13.6%) |

| Total income | 475.7 | 486.2 | (2.2%) |

| BAU expenses | 267.8 | 271.7 | (1.4%) |

| Investment spend | 27.8 | 27.5 | 1.1% |

| Total operating expenses | 295.6 | 299.2 | (1.2%) |

| Operating performance | 180.1 | 187.0 | (3.7%) |

| Credit expenses | 1.9 | (5.2) | Large |

| Cash earnings (after tax) | 122.2 | 132.6 | (7.8%) |

| Statutory net profit (after tax) | 109.8 | 108.4 | 1.3% |

Quarterly trading updates will now be included in the BEN reporting cadence, released Q1 and Q3 of the financial year.