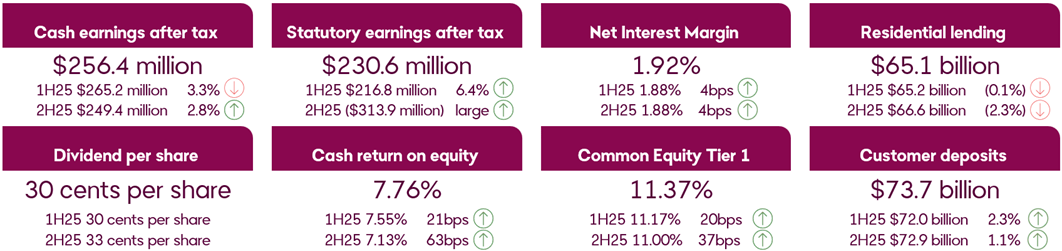

Bendigo and Adelaide Bank Limited (ASX:BEN) today reported cash earnings for the half of $256.4 million and statutory net profit after tax of $230.6 million. Cash earnings for the half were 2.8% higher than the prior half and down 3.3% on the prior comparative period. The Board determined to pay a fully franked interim dividend of 30 cents per share, which is stable on the prior comparative period.

“This result reflects good progress on our strategy over the half, with our deposit-led approach to drive sustainable loan growth gaining momentum and improving our earnings. This improvement was largely driven by the growth in lower cost deposits benefiting margin, as well as a reduction in costs in the second quarter. In addition, we made the strategic decision to exit our legacy mortgage partner business which impacted loan growth for the half. We remain confident that our residential lending book will return to growth over the second half of the financial year.

Over the half, we have delivered on several key milestones;

- Our digital transformation progressed with the full rollout of the Bendigo Lending Platform to all branches, the launch of direct customer onboarding through the Bendigo Bank app, and a new partnership with Google which will provide a range of new and enhanced capabilities with a strong focus on AI and cyber risk management.

- We completed the final phase of our multi-year core banking simplification project with the migration of 180,000 Adelaide Bank customer accounts to the Bendigo Bank platform, delivering on our long term goal of one core banking system.

- Our agreement to acquire RACQ Bank's loans and deposits book, set for completion in 1H27, will leverage our proven capability to integrate ~90,000 new customers. This acquisition will also increase our Queensland exposure by 3 percentage points to 18% of our total residential lending book.

As previously announced, to address deficiencies in our AML/CTF approach, we are launching a significant uplift program with a currently expected duration of up to three years and an initial estimated cost in the range of $70 million to $90 million. The estimated cost for 2H26 is approximately $15 million, which will be managed within our current year investment slate financial commitment.

As highlighted at our Investor Day in December 2025, we are in the second phase of our productivity program with advanced negotiations now underway in relation to a new information technology partnership and planning continues in relation to business processing. Collectively, these initiatives will provide access to enhanced capabilities, drive innovation and support our previous guidance of Business-as-Usual costs no higher than inflation through the cycle. We will provide further updates to the market through the course of 2H26.

Our balance sheet and capital position remains strong and well positioned for a return to growth in the second half of the financial year. The DRP underwrite announced this morning will further strengthen our capital position.

The Board remains committed to investing the capital required to drive our 2030 strategic initiatives while uplifting our AML/CTF risk management capabilities and integrating the RACQ Bank loan and deposit books. We reaffirm our objective to deliver improved returns to shareholders, targeting a ROE of above 10% by 2030.”

Richard Fennell, Managing Director and CEO

Financial Performance

Cash earnings of $256.4 million for 1H26 were 2.8% higher than 2H25, with income growth of 3.7% and expense growth of 4.2%. Customer deposit balances grew 1.1% whilst lending balances contracted 1.9%. Net Interest Margin increased 4 basis points over the half to 1.92%, reflecting our strategy to optimise our deposit franchise, with growth in lower-cost deposits supported by our refreshed Bendigo app.

Customer deposits grew 1.1% over the half, supported by lower cost deposit growth of 3.6%, while higher cost deposits contracted 1.7%. Our household deposit to loan ratio of 77.1% was up 4.3 percentage points over the half, with the mix of deposit funding improving significantly with lower-cost deposits increasing to 53.8% of total customer deposits, up from 52.4% in just six months.

Total gross loans contracted 1.9% over the half, with residential lending decreasing by 2.3%. Around two thirds of all residential lending settlements were driven by the branch network and our digital mortgage channels. This was offset by a reduction in Third Party originated channels which were impacted by our decision to exit the Mortgage Partner business. Residential lending applications continued to improve over the second quarter, and for the month of December were at their strongest level this financial year. Business lending grew 2.8% over the half, reflecting growth in Business loans and Portfolio Funding. In Agribusiness, favourable seasonal conditions and higher crop yields led to significant loan paydowns in late 2Q26 and a corresponding 6.2% decrease in agribusiness lending.

Up’s positive momentum continued over the half, with lending growth of 27% to $2.1 billion and deposit growth of 24% to $3.5 billion.

Total operating expenses increased by 4.2% on the prior half. The increase reflects a combination of higher software and amortisation charges, additional workdays and higher remediation expenses. Second quarter total expenses of $307.7 million were 6.4% lower than first quarter, mostly reflecting lower employee costs and investment spend.

Over the next six months, we expect to incur approximately $15 million on the AML/CTF Remediation Program and approximately $10 million on the initial work for the migration of RACQ’s loan and deposit book. We intend for these programs to both be funded through our previously guided investment spend.

Gross impaired loans decreased 3.1% over the half to $125.6 million, representing just 0.15% of gross loans. During the half, a net writeback of $2.4 million was driven by reduced asset balances and our strong credit profile. In residential lending, 90-day plus arrears increased by 3 basis points and in Agri, our 90-day plus arrears balance decreased over the half. However, stronger-than-expected seasonal inflows reduced the balance sheet, causing the arrears percentage to increase marginally.

Outlook

The Australian economy is showing positive signs, with a strong labour market and a recent surge in business investment pushing real growth beyond 2%. However, there are headwinds including lagging productivity in the economy. The recent rise in core inflation, together with the February interest rate hike, points to more restrictive policy settings ahead. Adding to this, ongoing trade and geopolitical uncertainties are creating a volatile global backdrop, however Australia is well positioned given our trade surplus and likely benefits via technological advancements.

While Australian households are challenged with rising cost of living, our home loan customers have shown financial resilience with 45% of mortgage customers over a year ahead on their mortgage repayments, and 88% maintaining their financial buffers.

The Bank’s balance sheet is well positioned for growth and resilient to external pressures. We remain committed to delivering improved value for our shareholders, underpinned by our disciplined focus on optimising our deposits, improving productivity and delivering sustainable growth.

2026 half year results webcast

The results presentation webcast will be held today, Monday 16 February 2026 at 10.00am (AEDT).

A replay of the webcast will be made available at the Bendigo and Adelaide website www.bendigoadelaide.com.au or via the following link – 2026 Half Year Financial Results Announcement.