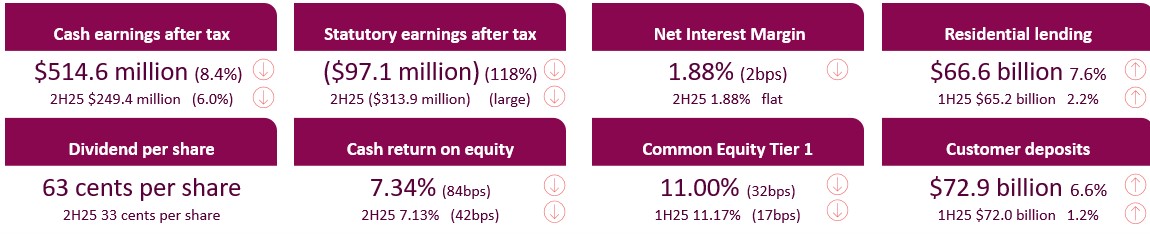

Bendigo and Adelaide Bank Limited (ASX:BEN) reported cash earnings for the year of $514.6 million and statutory net loss after tax of $97.1 million, with the latter driven largely by an impairment of goodwill announced last week. Cash earnings for the year were down 8.4%. The Board determined to pay a fully franked final dividend of 33 cents per share.

“The full year results we present today demonstrate our balanced approach in a challenging and competitive environment. The Bank has delivered more moderate growth and stable margin in the second half of FY25. This is in contrast to the first half where a significant increase in demand for our products placed margins under pressure. Expenses were higher year-on-year due to the planned increase in investment spend, as previously announced in the FY24 results. Pleasingly, our business as usual (BAU) expenses - which excludes investment spend - were well below inflation for the second half.

Our customer numbers continue to grow strongly, up 11% across the year to 2.9 million, while Bendigo Bank’s Net Promoter Score of +28.0 remains 36.4 points above the industry average. Our customer numbers continue to grow faster than any other major or regional bank. Our digital bank Up grew 29% to 1.2 million customers and now comprises more than 40% of the Bendigo Bank customer base. Up’s customer growth is supported by its unrivalled Net Promoter Score of +55.2.

Over the year, we continued to improve our digital capability with the rollout of the Bendigo Lending Platform to all of our broker partners and to mobile relationship managers in our retail network. We have reduced the number of core banking systems from three to two, further simplifying our business and technology platforms. We have retired the Rural Bank brand, completed the migration of Rural Bank customers to the Bendigo core system and streamlined product offerings with the sale of Bendigo Superannuation.

During the second half we appointed three new members to the Executive team and finalised our 2030 Strategic Plan. This strategy builds on the foundations of our multi-year transformation with a near-term focus on driving growth in lower cost deposits and realising productivity benefits through operational simplification. Bendigo Bank's refreshed climate approach is supporting our strategy, aligned with a 1.5°c future through the adoption of science-based targets. BEN 1.5°c balances our commitment to decarbonisation with sustainable business growth to enhance shareholder value.

Our balance sheet remains well positioned for the current economic outlook and to meet our growth targets with strong capital and liquidity positions at year end. Over the year, we booked a net write-back in credit expenses of $14.7 million, reflecting the high-quality nature of our loan portfolios.

The Board has determined to pay a fully franked final dividend of 33 cents, which is stable on the prior comparative period. The Board is committed to investing the capital required to support our 2030 strategic initiatives and to grow sustainably while delivering improved returns to shareholders.”

Richard Fennell, Managing Director and CEO

Financial Performance

Cash earnings of $249.4 million for the second half were 6.0% lower than in the first half, with income growth of 0.2% and expense growth of 2.1%. Excluding investment spend, expenses increased 0.3%. Lending balances increased 2.8% whilst customer deposit balances increased 1.2%. Net Interest Margin was flat over the second half at 1.88%, with active management of Consumer product pricing offsetting the impact of competitive pricing in Business & Agribusiness (B&A) lending and a reduced cash rate.

Customer deposits grew 6.6% over the year reflecting the strength of our brand and deposit franchise. Our household loan to deposit ratio of 72.8% was down 40 basis points over the half, remaining above the average of the four major banks. The mix of deposit funding has improved over the second half with lower-cost deposits up 3.3%.

Total lending grew 6.3% over the year with residential lending increasing 7.6%, driven by strong growth through our Bendigo Lending Platform. Across the second half there was a favourable shift in our channel mix with our proprietary and Community Bank branches accounting for 38% (up from 30%) of residential lending settlements, while the Bendigo Lending Platform accounted for 33% (up from 28%) and digital mortgages 16% (down from 19%). B&A lending grew 2.7% over the year, driven by growth in Portfolio Funding and Agribusiness.

Up’s positive momentum continued over the year, with a tripling of the mortgage book to $1.7 billion and deposit growth of 34% to $2.8 billion.

Total operating expenses increased by 7.7% for the year. The planned investment spend increase contributed 2.3% of the 7.7% increase. We continued to manage our BAU expenses prudently with operating expenses, excluding investment spend, contributing 5.4% of the increase. The increase in costs was due to wage and price inflation, technology costs and software amortisation. Overall, productivity benefits of $9.4 million were realised during the year contributing a 0.8% reduction in our cost growth.

Gross impaired loans decreased 4.5% over the year to $129.5 million, representing just 0.15% of gross loans. During the year, a net writeback of $14.7 million was booked, $11.0 million of which was in the collective provision and mostly reflecting a reduction in some overlays. In residential lending, 90-day plus arrears increased by 19 basis points towards pre-COVID levels for the Bank. In Agri, 90-day plus arrears increased due to delays in completing annual reviews, partly due to complexities arising from the Rural Bank customer migration.

Outlook

Australia’s economy is well positioned, with moderating inflation allowing for further RBA rate cuts while US tariffs will likely have a lower impact on the Australian economy to that of other economies. Underlying inflation is back within the RBA target range, allowing the RBA to take the cash rate to a more neutral level which should combine favourably with resilient labour markets and low unemployment. Globally, economic policy uncertainty remains elevated along with geopolitical tensions.

2030 Strategy

Our 2030 strategy is underpinned by the following five pillars; 1) Make life easy with digital, 2) Operate simply and efficiently, 3) Deepen customer relationships, 4) Set the benchmark for trust and societal impact, and 5) Reinvent banking for a new generation with Up.

These pillars will be supported by our key enablers, including uplifting our risk management capabilities, streamlining our technology foundations, and strengthening our performance culture through an operating model that aligns with our objectives. We have established a Strategic Execution Office to coordinate our execution approach, track our progress and ensure accountability.

Over the next two years we will focus on further activating our existing strong deposit franchise leveraging digital onboarding and our branch network, implementing productivity improvements, and driving sustainable lending growth funded mostly by lower-cost deposits. These initiatives are designed to consistently improve key financial metrics and deliver increased shareholder value.

We are targeting a Return on Equity above 10% by 2030.