The second Federal Budget this year was delivered in a very different global context than the pre-election vintage back in March, when the consequences of the invasion of Ukraine were initially being contemplated but full extent of the inflationary impact not yet apparent.

This budget had a number of unique contrasts including:

- A ‘post-election’ budget restating the March estimates but including the cost of the election policy commitments

- Enjoying the benefits of an $80 billion windfall compared to March due to lower unemployment and much higher commodity prices: so, the fruits of a very healthy domestic economy in FY22

- Suffering from the dismal global backdrop and outlook, due to the global energy and inflation shock

- A message from the Treasurer Jim Chalmers that budget repair and fiscal challenges will require action; but that any reform measures are not for this budget (potentially in the next budget, back at the normal time of May).

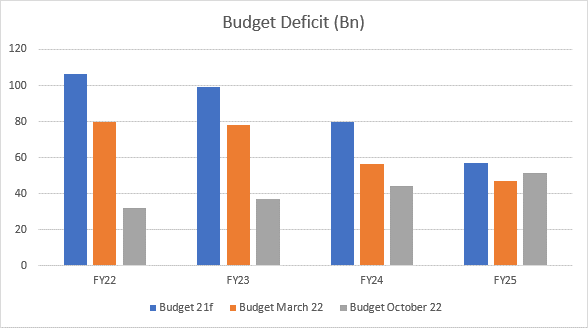

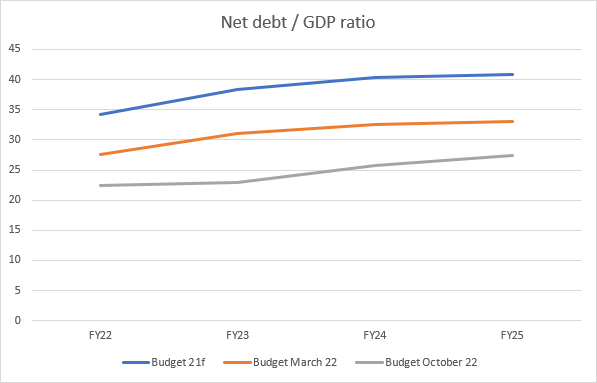

As a result, the deficits for last Financial Year and this (FY23) are significantly lower than Josh Frydenberg delivered in his estimates in March, but the forward estimates suffer from the inferior economic outlook for FY24 and beyond. The debt profile has improved in the short term, but the impact of RBA rate hikes (aiming to tackle inflation) and the structural deficits ahead due to an ageing population and a lack of productivity growth are evident in the numbers.

The Treasurer was keen to highlight ‘responsible’ cost-of-living relief, the need for fiscal discipline and the imperative to strengthen the economy; but used this budget to primarily reconcile the budget position post-election rather than tackling new reform (beyond election promises). The fact that the debt profile has improved (refer charts above) was brushed off as a temporary windfall, apparently justifying the dumping of some of the coalition’s spending commitments under the pretext of discipline. Net debt to GDP is forecast to still be only 28.5% by mid-2026 (although does eventually rise above 30%) so our AAA credit rating appears very safe.

The experience of the UK government and their overreach on fiscal support clearly showed the dangers of fiscal stimulus at the same time that the central bank is tightening policy, so this budget is unsurprisingly conservative. The danger however may lie in the tempering of infrastructure investment at the very time that productivity enhancing measures have become even more urgent. That is, the rise in inflation means real wages have fallen, and the medium solution to this problem lies in lifting productivity to increase wages so that the Wage Price Index exceeds the inflation rate.

‘Cost-of-living relief’ was provided in the Budget by election promises already well defined for cheaper child-care and Paid Parental Leave, but the announcement of a Housing Australia Future Fund for affordable housing and a national Housing Accord was a welcome addition. The public-private partnership involving local government, super funds and other stakeholders aims to build one million new homes (including 50, 000 affordable and social homes).

Winners included:

- Families and new parents (childcare subsidies and increased paid parental leave)

- Pensioners and self-funded retirees (further incentives to downsize and increases to thresholds for healthcare

- Students (480,000 fee-free TAFE places and additional university places for under-represented groups)

- Skilled migrants (an increase in the permanent migration program).

Losers included:

- A range of projects ($13.7 billion) previously committed by the coalition for regional infrastructure, business incentives and community programs

- Multinationals and foreign investors (increased fees and penalties for tax avoidance FIRB breaches

- The economy (based on the forecasts in the Budget: more on this below).

Economic forecasts were consistent with market consensus and reflect the impact of rising interest rates on top of surging inflation. The budget didn’t really influence where the economy is heading, but it did take guidance from the global backdrop and the slower economy here that the RBA is trying to engineer (to tackle inflation). Notably GDP is forecast to slow to 1½% in FY24, but still grow 3¼% this FY, which will be dependent on how far the RBA push interest rates (which will depend on how quickly inflation normalises).

David Robertson

Chief Economist, Head of Economic and Markets Research

Bendigo and Adelaide Bank Ltd

25th October 2022