Find out about our latest scam alerts and what to do if you've received a suspicious SMS.

New scam targets Chinese-speaking Australians with fake deportation threats

The bank is aware of scammers cold-calling Chinese-speaking Australians pretending to be the authorities and threatening deportation.

They accuse their targets of money laundering or other crimes and ask for payment so “Chinese police” can investigate without deporting them from the country. The scammers usually speak in Mandarin or Cantonese to establish authority or build trust.

How the scam works:

- Unexpected call: You receive a call from what appears to be a legitimate number, claiming to be the Chinese police, Australian government, or a bank, saying you’re involved in illegal activity or money laundering.

- Deportation threat: They demand payment from you to avoid being sent back to China.

- Pressure to transfer money: They instruct you to send funds to a Chinese or overseas bank account, often with fake excuses like:

- "Pay for an investigation to clear your name."

- "Avoid legal consequences by settling the case now."

- Cover-up story: The scammers coach you to lie to bank staff if questioned about the transfer, and suggest you claim the transfer is for family medical bills or other urgent expenses.

Red flags to watch for:

- Threats of arrest or deportation: Real authorities and government bodies won’t demand immediate payments over the phone.

- Pressure to stay silent: Scammers request secrecy and tell victims not to discuss the call with anyone.

- Demand bank transfers to China: Often to personal (not official) accounts.

How to protect yourself:

Stop. Hang up immediately if you feel pressured.

Think. Would Chinese or Australian authorities really demand money this way? No.

Protect. Never transfer money out of fear, speak to a trusted friend or your bank first.

If you think you have been a victim of a scam, report it at bendigobank.com.au/security/report-suspicious-activity or call us directly on 1300 236 344.

False billing scams targeting university students

The Bank is aware of scammers currently targeting students by impersonating Australian universities and seeking payment of ‘overdue tuitions fees.’

What to look out for:

- The subject line may include phrases like, ‘Final Reminder: Tuition Fee Outstanding Payment’;

- The email contains spelling, and grammar mistakes and sets the payment deadline as the same day the email is sent, creating a sense of urgency;

- It contains instructions to make a payment directly to a bank account and send proof to different email address;

- It includes threats of legal action if the payment is not settled.

How to protect yourself:

- Do not click any links, open attachments or reply to the email;

- If you have received an email like this – take the time to contact your university using contact details you've found independently, not on the email.

Remember:

- Stop. Take the time to contact your university using contact details you've found independently.

- Think. Ask yourself if you really know who you are communicating with. Scammers can make emails look authentic by copying logos, colours and ABNs.

- Protect. Act quickly if something feels wrong.

If you think you have been a victim of a scam, report it at bendigobank.com.au/security/report-suspicious-activity/ or call us directly on 1300 236 344.

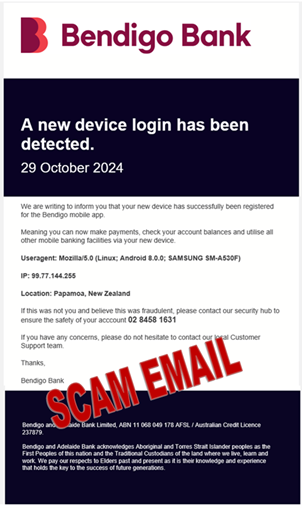

Fake new device login emails

The Bank is currently aware of Bendigo Bank branded phishing emails targeting customers. The scam email states a new device log in was detected and asks customers to call a fake security hub number.

These are not legitimate Bendigo Bank communications. Please do not click on any links or call the number in the email.

If you have received a suspicious email, you can forward it to phishing@bendigoadelaide.com.au for investigation.

If you think you have been a victim of a scam, report it at bendigobank.com.au/security/report-suspicious-activity or call us directly on 1300 236 344.

Phishing scam email example:

Let us know ASAP if you think you have been the victim of a scam

If you need help or more information

Phone

If you have clicked on any suspicious links and entered your e-banking details:

Call 1300 236 344 (in Australia) or +61 3 5445 0666 (from overseas - standard international call charges apply)

- Monday to Friday - 8am to 9pm AEST/AEDT*

- Weekends and some public holidays - 9am to 8pm AEST/AEDT

*Excludes Christmas Day

SMS

If you have received a suspicious SMS message claiming to be from us, you can forward it to 0429 557 997 for investigation.

Please note you will not receive a personal response from 0429 557 997.

If you have received any suspicious emails, you can forward them to us via email.

Please note you will not receive a personal email response from us.