ATMs

It's important to protect your Bendigo Bank card from unauthorised transactions. Here's some useful tips when interacting with our range of ATMs.

Things you can do with our ATMs

Transfer funds between accounts and check your balances

Change your PIN

Make deposits at selected ATMs

Locate your nearest ATM

Access overseas

There are more than 840,000 ATMs overseas that will accept your Bendigo Bank card. While travelling overseas, you can make withdrawals in local currencies from your Easy Money1, debit and credit card accounts at selected ATMs.

For ATM locations overseas, visit Visa or Mastercard.

Important to know

- Ensure that nobody observes your PIN being entered into an ATM

- If you notice suspicious behaviour near an ATM, do not proceed with your transaction

- When using an ATM, cover the keypad when entering your PIN

- Keep an eye out for people looking over your shoulder

- Notify us immediately if your card or PIN has been lost, stolen or compromised

- Keep us up to date if you change your contact details. This way we can contact you quickly about any suspicious transactions.

Learn more about keeping your PIN, passwords and access numbers secure.

Phone banking

It’s easy to use our automated phone banking at your convenience.

To use our phone banking, phone 1300 236 344 within Australia and press 1 for automated phone banking. From overseas, call +61 3 5445 0666

Phone banking features

When you call phone banking, you will automatically hear the balances of up to two of your bank accounts. We can substitute other accounts if you wish, simply press 0 to speak with a banking consultant.

Account balances

For your accounts held under your primary customer number, we can also link another 2 different customer numbers that will give you access to other accounts you are authorised to transact on.

Transaction summary

Details of the past 10 transactions on your bank accounts are read to you.

Transfer money between your accounts held under either your primary or linked customer numbers.

No transfers are allowed to or from term deposits, from loan accounts, or from accounts requiring more than one signature to authorise withdrawals.

To make a bill payment to a new or existing Biller

To make a bill payment to a BPAY biller, you can choose from one of the existing billers on your payee list, or add a new biller and make a payment at the same time. You can have up to 999 billers in your payee list and they are accessible via phone banking and e-banking.

To add to your personal biller list

You can add new billers to your payee list. A biller short code will be allocated for you to quickly identify the correct biller. You can print off this list if you are also registered for e-banking. Once your personal biller list has been established you can quickly make your payments.

To delete from your payee list

Simply select the biller that is no longer required. This will help to keep your list tidy and reduce confusion.

Order a statement

You can order a duplicate copy of a previous statement. A fee applies for this service.

For mortgage loan accounts only the last statement issued can be re-ordered.

Change your phone banking PIN

Choose a new 5 digit PIN, to change your PIN at anytime.

Change your selected quick balance accounts

You can speak with one of our banking consultants to ensure the balances you receive when you first logon are the ones most important to you. Alternatively if you would rather hear the list of all your balances, from the account information section, you can request to have no accounts listed for the quick balance service.

Getting started

You will need:

1. A touch tone phone

Most phones now are this type. Some phones have a switch allowing you to choose between pulse and tone.

2. An access number

To receive your access number, please contact your Bendigo Bank branch or telephone on 1300 236 344^ and press 0.

3. A PIN

When you call phone banking for the first time, you will be asked to select your own five-digit PIN number. Your phone banking PIN number should be kept secret to ensure you are the only person who can access your accounts.

4. A quick reference card

To help familiarise yourself with the phone banking options, there is a handy quick reference card available which you can:

- Collect from one of our branches;

- Request for one to be sent to you by speaking with one of our consultants; or

- Click on one of the links below to print your own copy.

Phone banking quick reference card

Phone banking quick reference card for Rural Bank Customers

Now you're ready

Simply by calling 1300 236 344^ you can start banking by phone the easy way.

^ For the cost of a local call. Charges from mobile phones will vary. From overseas call, +61 3 5445 0666 ; standard international call charges apply.

| Call 1300 236 344 |

|---|

| Press 1 |

| Enter Access ID then # |

| Enter PIN then # |

| Quick balances read |

| Press 1 Account information |

Press 2 Funds transfer |

Press 3 Bill payments |

Press 4 Other services |

|---|---|---|---|

| Press 1 Account balances |

Press 1 To make a bill payment to a new or existing biller |

Press 1 Order a statement |

|

| Press 2 Transaction summary |

Press 2 To add to personal biller list |

Press 2 Order a cheque book |

|

| Press 3 To delete from personal biller list |

Press 3 Change your PIN |

||

| Press 0 Change your selected Quick Balance Accounts |

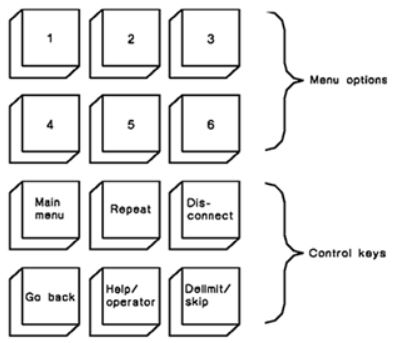

The following diagram shows the industry standard telephone keypad layout for IVR (Interactive Voice Response) systems. The numbers 1 to 6 are used for standard Menu options and the numbers 7 to 0 and the * and # function keys are used for other control commands as described on the relevant keys.

This layout should be reflective of the common layout for all IVR systems regardless of the company you are calling.

Need help? Call us or enquire

Branch banking

Our professional and friendly branch staff will always welcome the opportunity to speak with you. We pride ourselves on delivering outstanding service for all our customers, whether on-line or in-person.

If you visit one of our branches, you’ll have the chance to experience our customer care personally. With a comprehensive range of banking products and services, our staff will be ready to assist you with any of your banking needs.

-

Deposits and withdrawals

-

Savings and investment accounts

-

Home loans and personal loans

-

Credit and debit cards

-

Savings and investment accounts

-

Insurance

-

Business banking

-

Agribusiness

-

Managed funds

Find your nearest branch and opening times.

Bank@Post

Bank@Post ensures that every Bendigo Bank customer has access to complete banking services at more than 3,500 Post Offices in communities across Australia. Personal and small business customers have access to conveniently complete transactions at Bank@Post Post Offices.

- Cash deposits and withdrawals

- Cheque deposits

- Account balance enquiries

- Requires card access

If you are a Bank@Post customer experiencing financial difficulty or vulnerability, we encourage you to contact us via the Help & Support link.

If you have a complaint about Bank@Post please contact us.

Find your nearest Bank@Post Post Office

Banking Code of Practice

The Banking Code of Practice is a voluntary code of conduct which sets standards of good banking practice for us to follow when dealing with you.

A copy of the Code is available at your local branch, or you can download it from the Australian Banking Association website.

Further information is also available from the Australian Banking Association website.

The Banking Code Compliance Committee (BCCC), independently monitors compliance with the Banking Code of Practice. Further information about the BCCC can be found on its website.

If you have a complaint about the service for Bank@Post, our staff can help you and details on how to lodge a complaint please refer to the following link: Resolve a complaint.