Providing regular income and capital stability by investing in income-generating assets.

A different way to save

The Sandhurst Investment Term Fund's objective is to provide regular income and capital stability by investing in income-generating assets, including mortgage backed assets and first registered mortgages. You can choose from a range of investment terms – from 3 months to 5 years.

The Managed Fund product/s referenced on this page are issued by our wholly owned subsidiary Sandhurst Trustees Limited.

Low initial investment $2000

Investment terms from 3 months to 5 years

Access to Bendigo e-banking services2

How it works

Sandhurst aims to achieve the investment objective of the Fund by investing in a pool of diversified mortgage backed assets and direct mortgages that is consistent with our conservative lending policy.

The Fund also invests in deposits, money market securities and government backed securities to generate income and provide liquidity to the Fund.

Features

Regular income through monthly or quarterly income distributions

Choice to get income stream, which can be paid to you or automatically reinvested

Choice of investment terms to cater for a range of investors1

Additional feature - on the 3 year term investments there is a rainy day access feature, allowing you to withdraw3 up to 25% of the total amount invested for the term at any time.

Rates and fees4

Management fees

1.08% p.a. of the net asset value of the fund

Entry and exit fees

$0

Additional contribution fee

$0

Establishment fee

$0

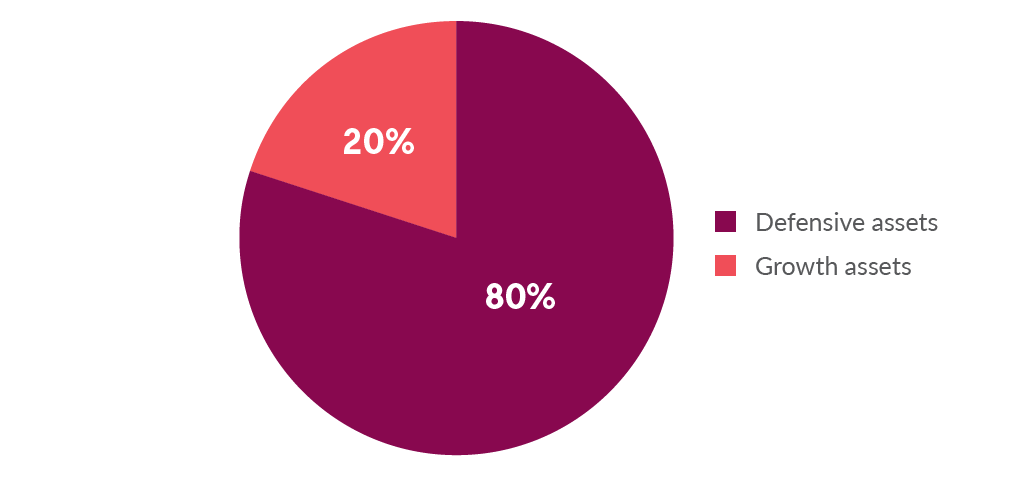

Defensive

To invest in this style, you would have a low tolerance for losses and risks which naturally leads you to give up on a larger return that comes with higher-risk investments. This investment style often looks to fixed income products such as cash, loan funds and bond funds. Usually at least 80% of this portfolio would be in defensive assets.

Risk profile

Low

Learn more about defensive investment style.

Ready to apply?

Move towards your goals. Apply today.

Important information

| Date | Distribution paid | 3 months % p.a. | 6 months % p.a. | 1 year % p.a. | 2 years % p.a. | 3 years % p.a. | 4 years % p.a. | 5 years % p.a. |

| 31 Oct 2024 | Quarterly | 4.50* | 4.55 | 4.20 | 3.90 | 3.90 | 4.00 | 4.05 |

| 21 Aug 2024 | Quarterly | 4.60* | 4.75 | 4.20 | 3.90 | 3.90 | 3.95 | 4.00 |

| 10 May 2024 | Quarterly | 4.40* | 4.75 | 4.15 | 4.10 | 3.90 | 3.95 | 3.95 |

| 10 Apr 2024 | Quarterly | 4.35* | 4.60 | 4.15 | 4.10 | 3.90 | 3.95 | 3.95 |

| 16 Jan 2024 | Quarterly | 4.35* | 4.45 | 4.15 | 4.10 | 3.90 | 3.95 | 3.95 |

| 7 Jul 2023 | Quarterly | 4.35* | 4.85 | 4.55 | 4.10 | 3.90 | 3.95 | 3.95 |

| 4 Apr 2023 | Quarterly | 3.30* | 4.20 | 3.75 | 3.50 | 3.50 | 3.55 | 3.65 |

| 7 Feb 2023 | Quarterly | 3.30* | 3.50 | 3.75 | 3.50 | 3.50 | 3.55 | 3.65 |

| 14 Dec 2022 | Quarterly | 2.75* | 3.10 | 3.35 | 3.35 | 3.40 | 3.55 | 3.65 |

| 20 Oct 2022 | Quarterly | 2.50* | 2.95 | 3.25 | 3.30 | 3.40 | 3.55 | 3.65 |

| 9 Sep 2022 | Quarterly | 1.70* | 2.25 | 2.75 | 3.00 | 3.10 | 3.15 | 3.25 |

| 5 Aug 2022 | Quarterly | 1.50* | 2.05 | 2.55 | 2.70 | 2.80 | 2.85 | 2.95 |

| 1 Jul 2022 | Quarterly | 1.30* | 1.75 | 2.25 | 2.70 | 2.80 | 2.85 | 2.95 |

| 22 Jun 2022 | Quarterly | 0.60* | 1.00 | 2.10 | 2.10 | 2.10 | 2.10 | 2.10 |

| 20 Apr 2022 | Quarterly | 0.30* | 0.40 | 0.70 | 1.30 | 0.70 | 0.70 | 0.70 |

| 22 Sep 2021 | Quarterly | 0.25* | 0.35 | 0.45 | 0.55 | 0.65 | 0.55 | 0.55 |

| 26 Feb 2021 | Quarterly | 0.25* | 0.45 | 0.55 | 0.55 | 0.65 | 0.55 | 0.55 |

| 11 Dec 2020 | Quarterly | 0.30* | 0.50 | 0.60 | 0.60 | 0.70 | 0.60 | 0.60 |

| 13 Nov 2020 | Quarterly | 0.35* | 0.55 | 0.65 | 0.70 | 0.70 | 0.70 | 0.70 |

| 15 Oct 2020 | Quarterly | 0.45* | 0.65 | 0.75 | 0.80 | 0.80 | 0.80 | 0.80 |

| 18 Sep 2020 | Quarterly | 0.60* | 0.75 | 0.85 | 0.95 | 0.95 | 0.95 | 0.95 |

| 14 August 2020 | Quarterly | 0.65* | 0.85 | 0.95 | 1.05 | 1.05 | 1.05 | 1.05 |

| 31 July 2020 | Quarterly | 0.75* | 0.90 | 1.00 | 1.15 | 1.15 | 1.15 | 1.15 |

| 12 Jun 2020 | Quarterly | 0.85* | 1.00 | 1.10 | 1.15 | 1.15 | 1.15 | 1.15 |

| 29 May 2020 | Quarterly | 0.90* | 1.10 | 1.20 | 1.15 | 1.15 | 1.15 | 1.15 |

| 22 May 2020 | Quarterly | 1.05* | 1.25 | 1.25 | 1.15 | 1.15 | 1.15 | 1.15 |

| 31 Mar 2020 | Quarterly | 1.15* | 1.40 | 1.45 | 1.20 | 1.20 | 1.25 | 1.25 |

| 12 Mar 2020 | Quarterly | 1.15* | 1.35 | 1.15 | 1.15 | 1.15 | 1.20 | 1.25 |

| 29 Jan 2020 | Quarterly | 1.35* | 1.60 | 1.50 | 1.45 | 1.40 | 1.40 | 1.45 |

| 24 Dec 2019 | Quarterly | 1.35* | 1.40 | 1.50 | 1.45 | 1.40 | 1.40 | 1.45 |

| 4 Oct 2019 | Quarterly | 1.35* | 1.30 | 1.25 | 1.25 | 1.30 | 1.30 | 1.30 |

| 16 Aug 2019 | Quarterly | 1.70* | 1.75 | 1.75 | 1.80 | 1.80 | 1.85 | 1.90 |

| 10 Jul 2019 | Quarterly | 1.70* | 1.95 | 2.05 | 2.30 | 2.30 | 2.35 | 2.40 |

| 12 Jun 2019 | Quarterly | 2.05* | 2.15 | 2.30 | 2.55 | 2.55 | 2.60 | 2.65 |

| 15 May 2019 | Quarterly | 2.15* | 2.35 | 2.50 | 2.70 | 2.80 | 2.80 | 2.85 |

| 26 Jul 2018 | Quarterly | 2.30* | 2.50 | 2.60 | 2.80 | 2.85 | 2.85 | 2.90 |

| 6 Jun 2018 | Quarterly | 2.15* | 2.25 | 2.45 | 2.70 | 2.85 | 2.85 | 2.90 |

| 23 Jan 2018 | Quarterly | 2.05* | 2.15 | 2.35 | 2.60 | 2.75 | 2.75 | 2.80 |

| 22 Mar 2017 | Quarterly | 2.15* | 2.30 | 2.50 | 2.70 | 2.85 | 2.90 | 3.05 |

| 16 Nov 2016 | Quarterly | 2.25* | 2.45 | 2.60 | 2.70 | 2.85 | 2.90 | 3.05 |

| 14 Sep 2016 | Quarterly | 2.40* | 2.55 | 2.70 | 2.80 | 2.90 | 3.00 | 3.15 |

| 13 Jul 2016 | Quarterly | 2.50* | 2.60 | 2.65 | 2.80 | 2.90 | 3.00 | 3.15 |

| 11 May 2016 | Quarterly | 2.60* | 2.70 | 2.75 | 2.90 | 2.95 | 3.00 | 3.15 |

| 24 Mar 2016 | Quarterly | 2.70* | 2.85 | 2.90 | 3.00 | 3.10 | 3.00 | 3.25 |

| 28 Oct 2015 | Quarterly | 2.60* | 2.65 | 2.70 | 2.80 | 2.95 | 3.00 | 3.25 |

| 23 Sep 2015 | Quarterly | 2.60* | 2.70 | 2.75 | 2.80 | 2.95 | 3.00 | 3.25 |

| 24 Jun 2015 | Quarterly | 2.70* | 2.80 | 2.85 | 2.85 | 3.00 | 3.05 | 3.30 |

| 13 May 2015 | Quarterly | 2.70* | 2.70 | 2.75 | 2.85 | 3.00 | 3.05 | 3.20 |

| 9 Apr 2015 | Quarterly | 2.80* | 2.85 | 2.90 | 2.90 | 3.10 | 3.15 | 3.30 |

| 3 Mar 2015 | Quarterly | 3.05* | 3.05 | 3.15 | 3.25 | 3.30 | 3.45 | 3.60 |

| 19 Dec 2014 | Quarterly | 3.30* | 3.30 | 3.40 | 3.60 | 3.90 | 3.85 | 3.95 |

| 26 Nov 2014 | Quarterly | 3.40* | 3.40 | 3.45 | 3.75 | 4.00 | 3.85 | 3.95 |

| 10 Jun 2014 | Quarterly | 3.50* | 3.55 | 3.55 | 3.90 | 4.10 | 3.85 | 3.95 |

| 29 Mar 2014 | On Maturity | 3.45 | 3.45 | 3.55 | 4.00 | 4.20 | 4.10 | 4.30 |

| 12 Feb 2014 | On Maturity | 3.45 | 3.45 | 3.55 | 4.00 | 4.20 | 4.10 | 4.30 |

| 30 Aug 2013 | On Maturity | 3.65 | 3.70 | 3.80 | 4.10 | 4.30 | 4.30 | 4.40 |

| 14 Aug 2013 | On Maturity | 3.90 | 4.00 | 4.00 | 4.20 | 4.40 | 4.50 | 4.50 |

| 29 May 2013 | On Maturity | 4.10 | 4.15 | 4.20 | 4.30 | 4.50 | 4.50 | 4.80 |

| 13 Mar 2013 | On Maturity | 4.20 | 4.30 | 4.30 | 4.40 | 4.60 | 4.50 | 5.00 |

| 13 Feb 2013 | On Maturity | 4.40 | 4.40 | 4.40 | 4.40 | 4.60 | 4.50 | 5.00 |

| 16 Jan 2013 | On Maturity | 4.45 | 4.50 | 4.50 | 4.40 | 4.60 | 4.50 | 5.00 |

| 14 Nov 2012 | On Maturity | 4.50 | 4.60 | 4.55 | 4.40 | 4.60 | 4.50 | 5.00 |

| 10 Oct 2012 | On Maturity | 4.60 | 4.70 | 4.65 | 4.50 | 4.80 | 4.50 | 5.00 |

| 27 Jun 2012 | On Maturity | 4.80 | 4.80 | 4.90 | 5.00 | 5.00 | 5.00 | 5.00 |

| 14 Jun 2012 | On Maturity | 5.10 | 5.15 | 5.10 | 5.00 | 5.20 | 5.00 | 5.00 |

| 31 May 2012 | On Maturity | 5.20 | 5.25 | 5.20 | 5.00 | 5.40 | 5.00 | 5.00 |

| 18 May 2012 | On Maturity | 5.30 | 5.40 | 5.25 | 5.00 | 5.50 | 5.00 | 5.00 |

| 12 April 2012 | On Maturity | 5.40 | 5.65 | 5.40 | 5.00 | 5.70 | 5.00 | 5.00 |

| 15 Feb 2012 | On Maturity | 5.40 | 5.60 | 5.20 | 5.00 | 5.55 | 5.00 | 5.00 |

| 23 Nov 2011 | On Maturity | 5.45 | 5.65 | 5.50 | 5.50 | 5.70 | 5.00 | 5.50 |

| 31 Aug 2011 | On Maturity | 5.50 | 5.80 | 5.75 | 5.70 | 5.80 | 5.00 | 6.00 |

| 28 Jul 2011 | On Maturity | 5.50 | 6.05 | 6.20 | 6.25 | 6.35 | 5.00 | 5.00 |

| 25 May 2011 | On Maturity | 5.50 | 6.10 | 6.30 | 6.40 | 6.50 | 5.00 | 5.00 |

| 23 Mar 2011 | On Maturity | 5.50 | 6.15 | 6.35 | 6.40 | 6.50 | 5.00 | 5.00 |

| 11 Dec 2010 | On Maturity | 5.50 | 6.20 | 6.45 | 6.40 | 6.70 | 5.00 | 5.00 |

| 19 Nov 2010 | On Maturity | 5.50 | 6.20 | 6.20 | 6.40 | 6.50 | 5.00 | 5.00 |

| 29 Sep 2010 | On Maturity | 5.25 | 6.10 | 6.20 | 6.40 | 6.50 | 5.00 | 5.00 |

| 11 Aug 2010 | On Maturity | 5.50 | 6.20 | 6.30 | 6.40 | 6.50 | 5.00 | 5.00 |

| 12 May 2010 | On Maturity | 5.50 | 6.10 | 6.15 | 6.40 | 6.50 | 5.00 | 5.00 |

| 24 Feb 2010 | On Maturity | 5.30 | 6.10 | 6.15 | 4.05 | 6.50 | 5.00 | 5.00 |

| 18 Jan 2010 | On Maturity | 5.20 | 6.05 | 6.00 | 4.05 | 6.50 | 5.00 | 5.00 |

| 09 Dec 2009 | On Maturity | 4.75 | 5.40 | 6.00 | 4.05 | 6.00 | 5.00 | 5.00 |

| 27 Nov 2009 | On Maturity | 3.00 | 5.40 | 6.00 | 4.05 | 6.00 | 5.00 | 5.00 |

| 16 Oct 2009 | On Maturity | 3.00 | 4.60 | 5.30 | 4.05 | 5.50 | 5.00 | 5.00 |

| 02 Oct 2009 | On Maturity | 3.00 | 4.60 | 5.15 | 4.05 | 5.50 | 5.00 | 5.00 |

| 28 Aug 2009 | On Maturity | 3.00 | 4.00 | 4.50 | 4.05 | 5.50 | 5.00 | 5.00 |

| 12 Jun 2009 | On Maturity | 3.00 | 3.75 | 3.80 | 4.05 | 4.20 | 4.00 | 4.10 |

| 16 Feb 2009 | On Maturity | 3.25 | 4.00 | 3.30 | 4.05 | 4.20 | 4.00 | 4.10 |

| 25 Dec 2008 | On Maturity | 3.90 | 4.00 | 5.00 | 4.90 | 4.85 | 4.90 | 4.90 |

| 11 Dec 2008 | On Maturity | 6.00 | 5.10 | 5.50 | 5.85 | 5.20 | 5.35 | 5.40 |

| 20 Oct 2008 | On Maturity | 6.25 | 6.50 | 6.60 | 7.20 | 5.60 | 6.00 | 6.00 |

| 08 Aug 2008 | On Maturity | 6.25 | 8.40 | 8.60 | 8.65 | 8.20 | 7.05 | 7.25 |

| 04 Aug 2008 | On Maturity | 6.25 | 8.40 | 8.10 | 7.50 | 7.05 | 7.05 | 7.25 |

| 27 Jun 2008 | On Maturity | 6.25 | 8.20 | 8.10 | 7.50 | 7.05 | 7.05 | 7.25 |

| 12 May 2008 | On Maturity | 6.25 | 7.40 | 8.10 | 7.50 | 7.05 | 7.05 | 7.25 |

| 14 Dec 2007 | On Maturity | 5.75 | 7.40 | 7.65 | 6.75 | 7.05 | 7.05 | 7.25 |

| 23 Jul 2007 | On Maturity | 5.75 | 5.95 | 6.50 | 6.75 | 7.05 | 7.05 | 7.25 |

| 01 Sep 2006 | On Maturity | 5.75 | 5.95 | 6.30 | 6.55 | 6.80 | 7.05 | 7.25 |

| 01 Aug 2006 | On Maturity | 4.85 | 5.25 | 6.05 | 6.30 | 6.65 | 6.85 | 7.05 |

| 15 May 2006 | On Maturity | 4.85 | 5.25 | 5.75 | 5.95 | 6.30 | 6.40 | 6.55 |

| 1 Oct 2005 | On Maturity | 4.85 | 5.25 | 5.55 | 5.70 | 5.95 | 6.10 | 6.30 |

| 25 Apr 2005 | On Maturity | 4.85 | 5.25 | 5.80 | 6.05 | 6.30 | 6.45 | 6.65 |

| 20 Dec 2004 | On Maturity | 4.60 | 5.00 | 5.55 | 5.75 | 6.00 | 6.20 | 6.45 |

| 27 Sep 2004 | On Maturity | 4.60 | 5.00 | 5.70 | 6.00 | 6.30 | 6.50 | 6.75 |

| 17 Mar 2004 | On Maturity | 4.60 | 5.00 | 5.80 | 6.05 | 6.35 | 6.55 | 6.80 |

| 22 Dec 2003 | On Maturity | 4.60 | 5.00 | 5.30 | 5.65 | 5.90 | 6.10 | 6.45 |

| 04 Mar 2003 | On Maturity | 4.20 | 4.50 | 4.60 | 4.90 | 5.25 | 5.50 | 5.75 |

| 23 Dec 2002 | On Maturity | 4.20 | 4.50 | 4.85 | 5.30 | 5.65 | 5.90 | 6.20 |

| 21 Jun 2002 | On Maturity | 4.20 | 4.50 | 4.85 | 5.45 | 6.15 | 6.55 | 6.95 |

Need help?

Enquire online

Send us an online enquiry if you have any questions.

Phone

Call us today between 8.30am to 5pm (AEST/AEDT)

At a branch

Use our branch locator to search for a branch near you.

Education HUB

Learn about topics that matter to you.

Things you should know

Target Market Determinations for products are available.

Early withdrawal may be available at Sandhurst’s discretion in special circumstances, although penalties may apply in the form of a reduced rate of return. From 21 August 2024 the reduced rate of return is 1.00% p.a. and is subject to change. Accessing your funds under the rainy day terms, does not result in a reduced rate of return.

The managed fund described is issued by Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst), a subsidiary of the Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879 (the Bank). Both of these companies receive remuneration on the issue of the product or service they provide. Investments in this Fund are not deposits with, guaranteed by, or liabilities of the Bendigo and Adelaide Bank Limited, or any other bank and are subject to normal investment risk including loss of some or all of the principal invested. Past performance is not an indication of future performance. Please consider your situation and read the PDS before making an investment decision.

1 Sandhurst may at its discretion consider an early withdrawal request (other than Rainy Day Access) from the Fund under special circumstances. Sandhurst reserves the right to reduce the rate of return payable on the investment if an early withdrawal is approved. The current reduced rate of return is published on the rate board matrix

2 Please contact 1300 236 344 to apply for e-banking services. Approval is subject to Bendigo Bank’s discretion.

3 Sandhurst shall satisfy withdrawal requests as soon as practicable (generally on the same day, but not more than 12 months). However, withdrawal requests may be delayed or refused if in Sandhurst’s reasonable opinion it is in the best interests of investors as a whole to do so. Investors will only have limited rights to withdraw if the Fund does not satisfy the liquidity test in the Corporations Act. There is a risk that withdrawal proceeds will not be paid within a reasonable period after the initial investment term.

4 Management fees and costs are based on fees and costs incurred by the Fund in the past financial year and may be different in the current and future financial years. Other fees and costs may apply. See the PDS for full details.

Please see a copy of the relevant Valuation Policy here

Sandhurst Trustees

Sandhurst Trustees Limited ABN 16 004 030 737 AFSL 237906 (Sandhurst) is a wholly owned subsidiary of Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL 237879. Sandhurst is the responsible entity and issuer of the managed funds available on this website. Additionally, Sandhurst is the issuer of commercial lending products and the provider of traditional trustee services available on this website. Each of these companies receives remuneration on the issue of the product or service they provide. Investments in these products are not deposits with, guaranteed by, or liabilities of Bendigo and Adelaide Bank nor any of its related entities, and are subject to normal investment risk, including possible delays in repayment and loss of income and capital invested.

Information on the website is jointly prepared by Sandhurst and Bendigo and Adelaide Bank and subject to change without notice. Advice in relation to managed funds and commercial lending products is provided by Sandhurst. The information contains general advice only and does not take into account your personal objectives, situation or needs. Before making an investment decision in relation to these products you should consider your situation and read the relevant Product Disclosure Statement available on this site.

The information is given in good faith and has been derived from sources believed to be accurate at its issue date. Neither Sandhurst nor the Bendigo and Adelaide Bank give any warranty for the reliability or accuracy or accept any responsibility arising in any way, including by reason of negligence for errors or omissions for the information contained on this website. Neither Sandhurst nor the Bendigo and Adelaide Bank has an obligation to update, modify or amend this website or notify you in the event that a matter of opinion or projection stated changes or subsequently becomes inaccurate.

Neither Sandhurst nor Bendigo and Adelaide Bank is responsible for the content of any other site accessed via this site. That information is the responsibility of the site owner. Links to other sites are provided for convenience only and do not represent any endorsement by Sandhurst or the Bendigo and Adelaide Bank of the products and services offered by the site owner.