Making the most of the interest free period on your credit card can save you money, as well as helping you feel more confident about managing your finances in the best possible way.

Credit card interest, and how it works, can be a bit confusing at times, especially if some of the language is a bit hard to understand.

We want to help you understand how credit card interest works, and to explain how to get the most out of your interest free period.

What is interest?

A credit card's interest is the cost linked with borrowing money from your bank. Interest rates are usually stated as an annual percentage rate. The purchase interest rate is generally advertised and applies when there is no interest free period.

What is an interest free period?4

An interest free period is the time between your purchase and when you’re charged interest (provided you don’t already owe money on your credit card).

Interest free periods are offered on most credit cards, generally on purchases up to a certain number of days.

How to take advantage of your interest free period?4

Understanding how interest free periods work allows you to make better decisions on how to manage your everyday spending.

Paying your closing balance off in full each month will allow you to make the most of an interest free period. A couple of ways to do this include creating a reminder to ensure you pay your full balance in time, or trying to plan larger purchases at the beginning of each statement period, so that you have more time to repay.

How does an interest free period work?4

An interest free period is determined by whether the closing statement balance is paid in full by the due date.

A typical interest free period is made up of your 30-day statement cycle, plus the 25 days to the payment due date. The number of interest free days will vary for each transaction, depending on which day in the 30-day statement cycle your purchase is made.

We’ve created some examples to help your understanding of interest free periods. It’s important to note in all our examples below, the interest free period on purchases is up to 55 days.

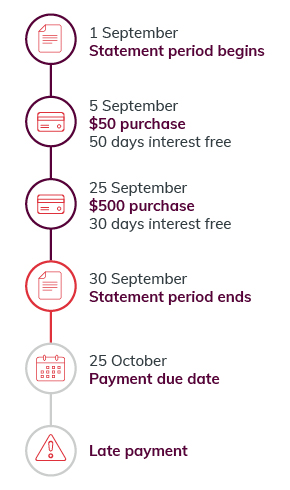

Understanding the interest free period

-

1 September

The statement period begins. -

5 September

You make a purchase of $50. Since the purchase was made 5 days after the statement periods began, the interest free period on this purchase is 50 days. -

25 September

You make a purchase of $500. Since the purchase was made 25 days after the statement periods began, the interest free period on this purchase is 30 days. -

30 September

Your statement period ends and you’ll receive your statement. The statement will detail you have 25 days to pay off the closing balance in full, which is made up of the purchases you made during the period. In this example, the closing balance is $550. -

25 October

This is the payment due date for the statement period. To avoid paying interest on purchases, you must pay the closing balance in full by the payment due date. If you don’t pay in full you will lose your interest free period on purchases and interest will be charged on the unpaid balance (including any purchases made since the last statement period ended) from after the due date. - If you don’t make a payment by the due date each month, a late payment fee will apply.

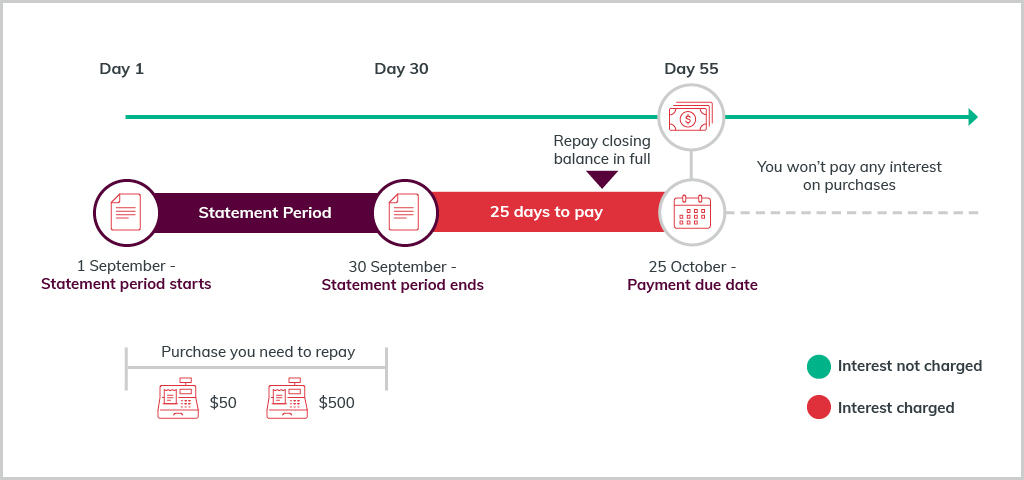

How to keep your interest free period?4

If you pay your closing balance in full by the due date each month, you’ll keep your interest free period for all new purchases you make after your due date, until your next due date.

-

1 September

The statement period begins. -

1 September to 30 September

You make two separate purchases totalling $550. -

30 September

Your statement period ends and you have 25 days to repay your purchases totalling $550. -

20 October

You repay the closing balance in full $550. -

25 October

Payment due date, and because you’ve paid the closing balance in full before the payment due date you keep your interest free period therefore not paying any interest on purchases.

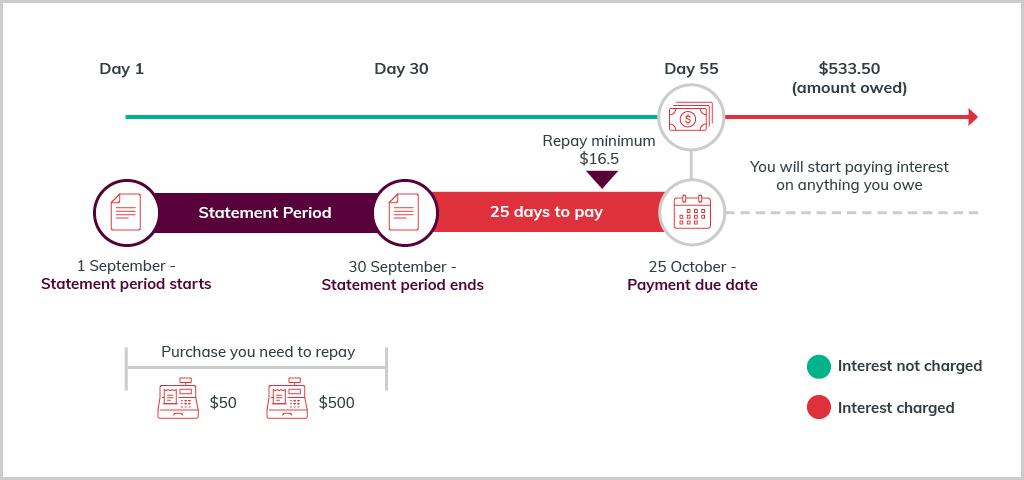

What happens if you can’t pay your closing balance in full?

If your closing balance isn’t paid in full by the due date, you’ll lose your interest free period and interest will be charged on the unpaid closing balance. You will also pay interest on new purchases after the due date, until it is repaid in full.

Keep in mind that if you only make the minimum repayment, your interest free period will also be lost, and interest will be charged.

-

1 September

The statement period begins. -

1 September to 30 September

You make two separate purchases totalling $550. -

30 September

Your statement period ends and you have 25 days to repay your purchases totalling $550. -

20 October

You repay only the minimum repayment of $16.50. -

25 October

Payment due date. As you have only paid the minimum repayment and not the closing balance in full before the payment due date, you lose your interest free period. Therefore will start paying interest on the unpaid amount of $533.50.

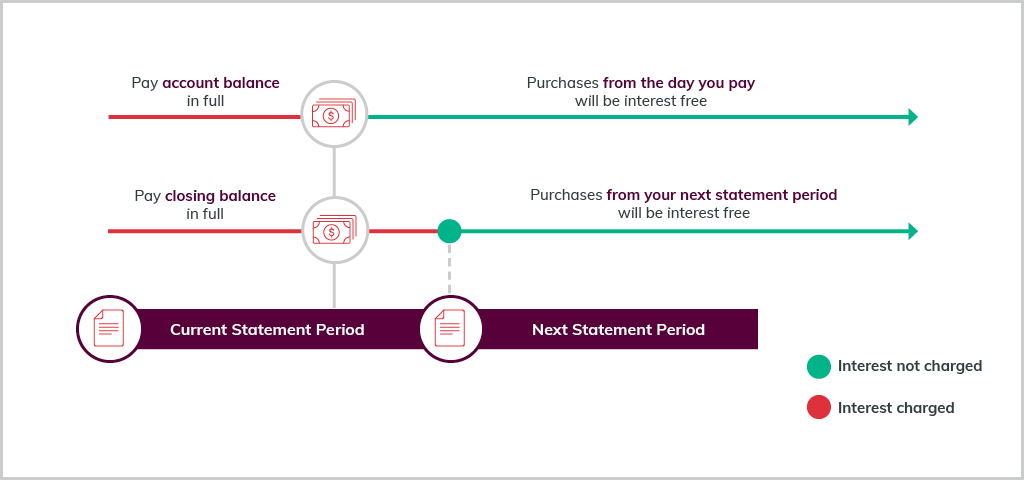

How you can regain your interest free period?4

If you’ve been paying interest, you can regain your interest free period by:

- Paying your account balance3 (excluding any promotional balance transfers) in full to get the interest free period back on all purchases from that day.2 You can view your account balance in e-banking. This will be displayed as your current balance when you select and view your credit card account.

- Paying your closing statement balance (excluding any promotional balance transfers) in full by the due date to get the interest free period back on new purchases from your next statement period. Your closing statement balance is available on the first page of your most recent statement.

- Paying sooner - the sooner everything is paid off, the less interest you’ll need to pay. Remember, you don’t have to wait until the due date to make a repayment.

The examples above are for explanation purposes only based on the following assumptions:

- The interest free period is up to 55 days.

- The previous closing balance has been paid in full by the due date each month.

- Examples are eligible for an interest free period on purchases and this is continued so to maintain an interest free period.

- Only purchases have been made and no balance transfers or cash advance transaction apply.

- Information is of an educational nature only and must not be relied upon as financial advice.

You may also be interested in

Things you should know

Terms and conditions, fees and charges apply. All information including interest rate is subject to change without notice. Full details available on application. Lending criteria apply. Credit provided by Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL/Australian Credit Licence 237879 (‘Bendigo Bank’).

2Please note: sometimes we don’t receive payments in time to process them the same day as they are made. For example, if transferred from another financial institution, which may affect this.

3Pending transactions are not included in your account balance.