Get started with Bendigo Invest Direct (BID) and manage your investments anytime, anywhere.

Why trade with Bendigo Invest Direct?

Ease of use

- Sign up in minutes

- Easy-to-navigate platform

Trade with perks

- $0 brokerage on selected international markets (US, UK, Japan & Canada)*

- Quick access to watch lists, market news, research and pricing

Secure and easy accessibility

- Protect your account with fingerprint and facial recognition

- Access your trading account on app or browser

Compare our platforms

Whether you’re new to investing or you’re already an industry pro, BID has a platform to suit your needs.

What kind of securities can I trade?

Australian shares

Buy part ownership of a listed company on the ASX.

International shares

Further diversify your portfolio and access a growing number of international markets.

Exchange traded funds (ETFs)

A simple way to buy a diversified portfolio of investments. Get all the benefits of index funds and the flexibility to buy and sell on the ASX.

Options

Flexible tools that appeal to active investors. Used wisely, options have the power to protect, grow or diversify your position.

Warrants

Another way to access some of Australia's leading companies’ shares and a variety of other underlying instruments.

mFunds

Diversify your portfolio and invest in unlisted managed funds through the mFund Settlement Service. All brought to you by the ASX, via our online platform.

Interest rate securities and bonds

Investing in bonds and interest rate securities allows you to diversify your portfolio and lend money to the issuer. This loan is paid on a fixed or floating rate of return.

Listed investment companies (LICs)

Like managed funds and ETFs, LICs invest in a diverse portfolio of assets - all maintained by experts.

Funding your trades

When trading with BID, you can either use your own funds with a Bendigo Cash Settlement Account or borrowed funds with a margin loan.

All markets. One account.

Please note: International trading is not available to BID accounts that are funded by a margin loan.

| Australia | United States | ||

| United Kingdom | Hong Kong | ||

| Canada | Singapore | ||

| France | Netherlands | ||

| Belgium | Switzerland | ||

| Germany | Japan | ||

| New Zealand | Denmark | ||

| Spain | Sweden |

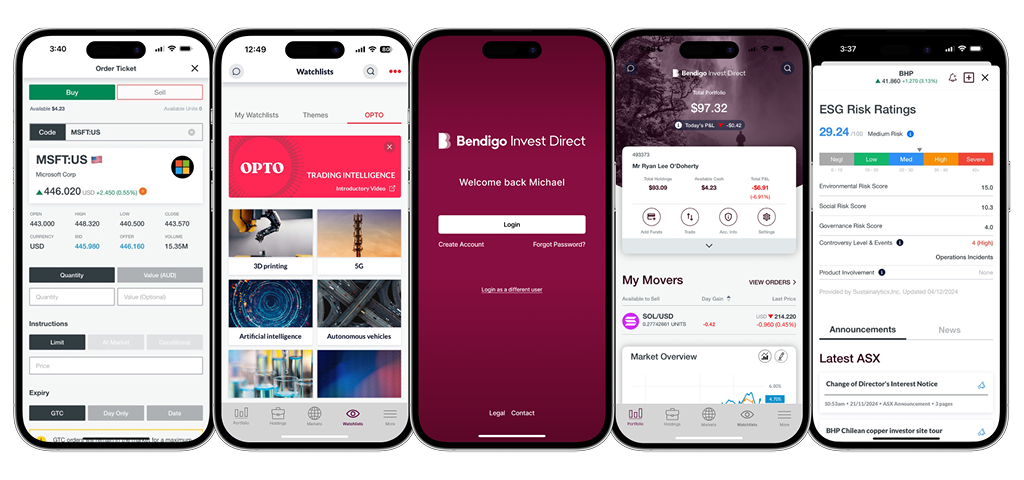

Discover the BID app

- Enjoy instant access to your cash/margin loan funded stockbroking account to manage orders

- View and manage current positions, trade confirmation, current balances, profit and loss

- Advanced order ticket with market, limit, good till cancelled and conditional order types

- Quick access to watch lists, research, pricing, as well as market and stock news from the ASX, Morningstar, and Dow Jones

- Secure and easy accessibility with fingerprint and facial recognition

Please note: To use this app you will need to have an existing Bendigo Invest Direct account.

Download the BID app now.

The Bendigo Bank difference

Our customers are helping change lives and save lives simply by trading with us.

When you apply for a Bendigo Invest Direct account, input a Community Bank branch of your choice. With that simple action, you'll be contributing to your local community with every trade, as a portion of the brokerage fee will be shared with your preferred Community Bank branch.

Helpful tools

Dedicated customer support

Online

Complete the online enquiry form and our team will be in touch.

Phone

Our dedicated customer support team are here to help.

You may also be interested in

Things you should know

*Online trades only. Other fees are involved when trading international shares. Brokerage rates apply to trades outside the selected markets. Refer to the full list of brokerage rates for more information.

Bendigo Invest Direct is a service provided by CMC Markets Stockbroking Limited ABN 69 081 002 851 AFSL No. 246381 (“CMC Markets Stockbroking”), a Participant of the ASX Group (Australian Securities Exchange), SSX (Sydney Stock Exchange) and Cboe (previously known as Chi-X) at the request of Bendigo and Adelaide Bank Ltd (ABN 11 068 049 178, AFSL 237879) (“Bendigo"). For a copy of the terms and conditions relating to the Bendigo Invest Direct services and the Financial Services Guides for CMC Markets Stockbroking or Bendigo (or other relevant disclosure documents), contact us on 1300 788 982, visit trading.bendigoinvestdirect.com.au/forms- external site or via email at info@bendigoinvestdirect.com.au. Neither CMC Markets Stockbroking nor Bendigo are representatives of each other. To the extent permitted by law, Bendigo will not guarantee or otherwise support CMC Markets Stockbroking’s obligations under the contracts or agreement connected with Bendigo Invest Direct.

Information is general advice only and doesn't take into account your personal objectives, financial situation, or needs. You should consider its appropriateness to your circumstances before acting on this information. Please read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Please also review our Financial Services Guide (FSG) before accessing information on this website. Information on this page can change without notice to you.

Gearing involves risk. It can magnify your returns; however, it may also magnify your losses.

The Leveraged Equities Margin Loan, Investment Funds Multiplier and Direct Investment Loan are issued by Leveraged Equities Limited (ABN 26 051 629 282, AFSL 360118) ("Lender") as Lender and as a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178 AFSL 237879) ("Bendigo"). The Lender and Bendigo receive remuneration on the issue of the product or service they provide. Investments in this product are not deposits with, guaranteed by, or liabilities of Bendigo nor any of its related entities.