Highlights for cattle

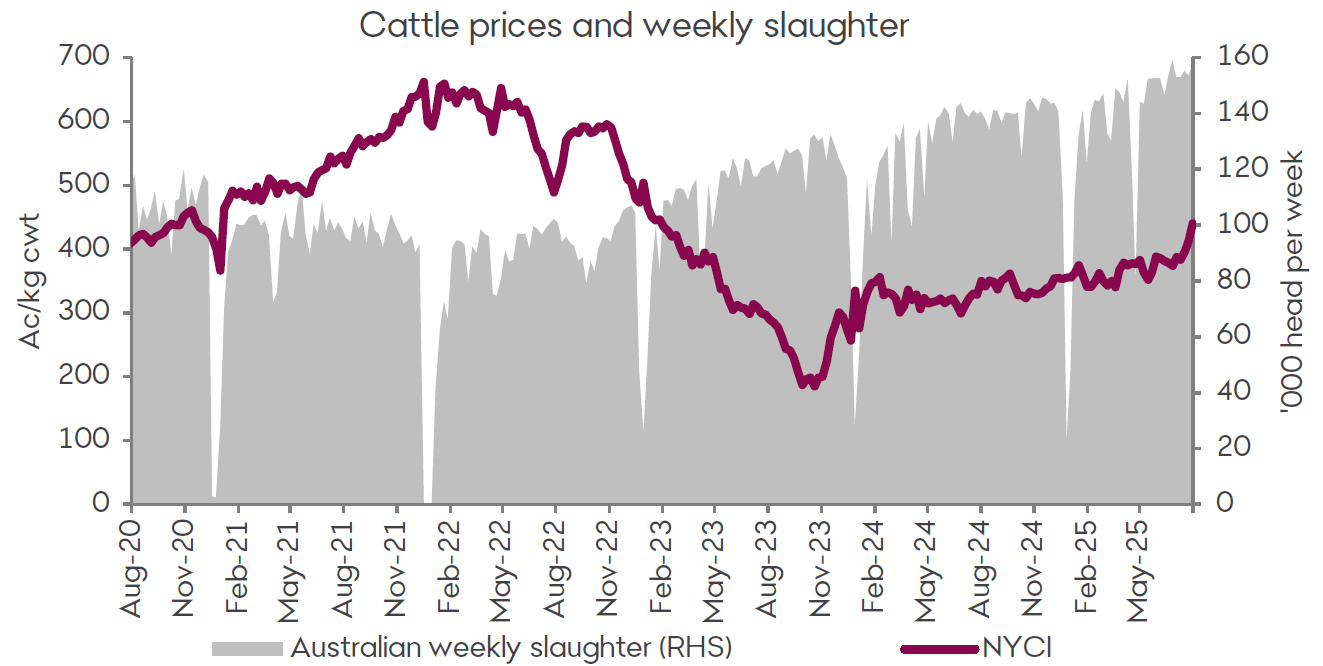

- The Australian cattle industry saw a big July on all fronts. Local cattle prices soared and now sit above the five-year average for the first time in a long time. National weekly cattle slaughter remained mostly stable, just above the 150,000 head on average. Export volume continued to climb and reached a new record monthly high of just under 150,500 tonnes. Export growth was again led by the United States. The volume of exports to the US continues to increase, sitting at just over 43,000 tonnes (up 22 per cent from the previous month). The question on the minds of many within the cattle industry is just how high can beef exports go.

- International demand for Australian beef continues to boom, South Korea saw just under 21,000 tonnes (one of the highest volumes on record) and exports to China continues to grow as well. Exports to China have flown under the radar and taken a back seat to the US but they remain extremely strong too. The volume of beef transported to China lifted 13 per cent month-on-month and this was 90 per cent greater year-on-year. Cattle prices are forecast to again see upside in August thanks to a favourable weather outlook across most regions along with the extremely high demand for exports. However, weather issues did slow how many cattle could get to saleyards in July which could limit strong price growth as more return to market barring any further weather constraints.

Tom Herbert

Tom combines his agricultural degree with strong industry knowledge to provide commentary on local and international beef and cattle market trends.

Bendigo Bank Agribusiness Insights publication(s) are for information purposes only and contain unsolicited general information, without regard to any individual objectives, financial situation or needs. Please refer to the terms and conditions.