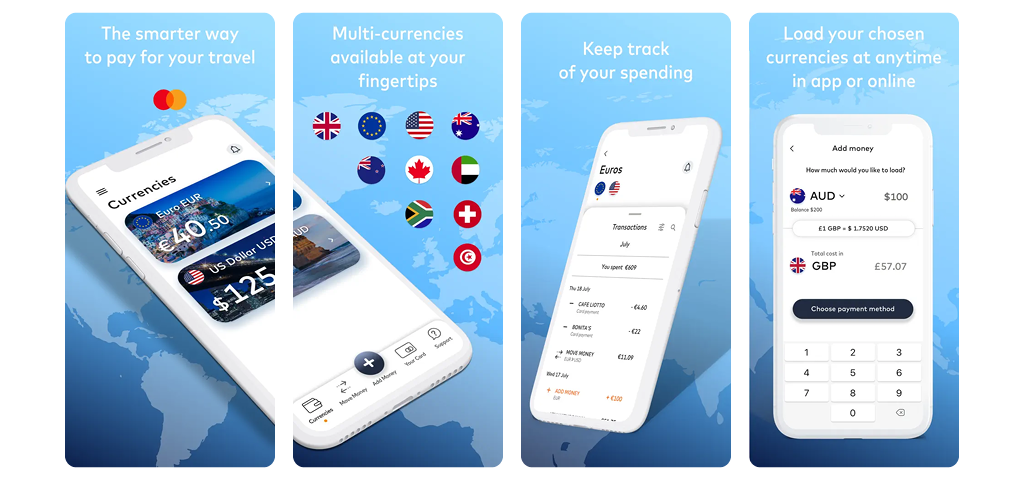

Travel overseas easier with Cash Passport™ Platinum Mastercard®

Three reasons you'll love Cash Passport

Know what you've got to spend

Lock in exchange rates for up to 10 foreign currencies, or load AUD and spend in over 140 currencies worldwide.

Shop like a local

$0 initial load fee and no international transaction fees on purchases when you load and transact in the same currency.

Peace of mind while overseas

24/7 global support always means we're always there to help if your card is lost, stolen, or damaged.

Features of your travel card

Fast and easy reloads

Reloadable, allowing you to top-up any of your currencies, anywhere, anytime.

You can reload online in three ways:

- Transfer funds from your Debit Card (instant)

- Bank transfer (1 business day)

- BPAY® (up to 2 business days)

Travel the world with one card

You receive a physical card, and can use it as you would any other Mastercard worldwide. Use it in store, online, or to withdraw local currency at ATMs.

Card security

Cash Passport Platinum is secured with Mastercard Zero Liability.5 It protects you against unauthorised and fraudulent transactions.^

Platinum benefits

Flight delay pass

Turn a delay into a lounge stay! Enjoy complimentary access to over 1,000 LoungeKeyTM airport lounges worldwide when your flight is delayed for 2 hours or more.#

Getting your pass is easy:

- Register a flight

- Flight monitoring

- Redeem lounge visit

Purchase protection

Purchase protection: shop protected from theft and accidental damage.^

Price protection: shop at the best price.

E-commerce purchase protection: shop with confidence.^

Mastercard travel rewards

- Card holders have access to exclusive savings when they shop on holiday. Terms and conditions apply.^^

- Simply pay with your card at a participating overseas merchant and get cash back. No coupons or offer codes needed. Save on just about everything you need: shopping, dining, excursions, and local transportation. Check out the current offers.

Currencies available

Lock and load money between your currencies with just a couple of taps – it’s that simple! Spend more time enjoying your holiday by quickly moving money between 11 currencies:

|

|

|

|

|

|

|

|

|

|

|

Download the app

Ready to order?

1. Order online

Select your currencies and verify your identity using your Australian driver’s licence or Australian passport.

2. Make payment

Pay for your initial load instantly with your Debit Card. Don’t have a debit card? We also accept BPAY.

3. Get your card

Upon receiving your load, your card will be immediately dispatched to your home address within 3 business days.

Support

Contact us

Need to speak with us? We're here to help.

FAQs

View our frequently asked questions.

Exchange rates

Accepted at millions of locations. Check today's exchange rate for your choice of currency.

You may also be interested in

Things you should know

Mastercard Prepaid Management Services Australia Pty Ltd (ABN 47 145 452 044, AFSL 386 837) arranges for the issue of the Cash Passport™ Platinum Mastercard® (“Cash Passport”) in conjunction with the issuer, EML Payment Solutions Limited (“EML”) (ABN 30 131 436 532, AFSL 404131). You should consider the Product Disclosure Statement available at Cash Passport Product Disclosure before deciding to acquire the product. The Target Market Determination for this product can be located at Cash Passport TMD. Any advice does not take into account your personal needs, financial circumstances or objectives and you should consider if it is appropriate for you.

Bendigo and Adelaide Bank Limited ABN 11 068 049 178. AFSL No. 237879 is authorised by Mastercard to distribute this product and receives a commission of equal to 50% of the foreign exchange revenue earned on the initial load or reload transaction. Payments are made monthly. We may also charge you a fee of up to 1.1% of the AUD equivalent value or $15 on the amount loaded by a customer onto their Cash Passport Platinum Mastercard® when they purchase or reload it at one of our branches (this fee will be retained by us). This is included in the amount that you pay for the product.

5Mastercard Zero Liability: Conditions for protection apply, see mastercard.com.au/zero-liability

# Flight Delay Pass is provided to you on the basis you are not in breach of Cash Passport MasterCard® Product Disclosure Statement and Terms & Conditions and your card remains open. It must not be sold in any way and Mastercard reserves the right to cancel the pass that are in breach of this policy. Access may not be available if the applicable lounge is full or near capacity at the full discretion of lounge staff. Access and use of the lounges is subject to its own terms and conditions. Mastercard reserves its right to amend or withdraw the Flight Delay Pass at any time and where possible, provide prior notice to you. Visit here for Terms and Conditions.

+T&Cs apply. Customer must contact Customer service to report lost or stolen card. Emergency cash can be arranged up to the balance on your Cash Passport, subject to availability of funds at the approved agent location.

^ Purchase Protection, Price Protection and E-Commerce Purchase Protection is provided under a group policy issued by AIG Australia Ltd (ABN 93 004 727 753, AFSL 381 686) (AIG) to Mastercard Asia/Pacific Pte. Ltd. Cover is available to Cash Passport Platinum Mastercard Cardholders (Eligible Person). Eligible Persons can claim under the Group Policy as third-party beneficiaries in accordance with section 48 of the Insurance Contracts Act 1984 (Cth). If an Eligible Person wishes to claim, such claim will be subject to the eligibility criteria, terms, conditions, exclusions, limits and applicable sub-limits as further detailed in the terms and conditions for such coverage found at Cash Passport Platinum Mastercard Complimentary Insurance Terms and Conditions. In arranging these Insurances Mastercard Asia/Pacific Pte. Ltd. is acting as a group purchasing body under ASIC Corporations (Group Purchasing Bodies) Instrument 2018/751.

^^ Individual terms and conditions (T&Cs) apply to each offer. The T&Cs of each offer are specified here. Cashback is available on international spend only. Cashback is not available for any local or domestic spend (in Australia). Cashback applies to qualifying transactions only (where a cardholder makes a purchase that meets the cashback offers published criteria and the specific T&Cs, in the local currency stipulated). Cashback is not processed immediately and will not reduce the purchase price of goods and services at the point of sale. The processing of cashback offers is undertaken by automated Mastercard systems and will appear as a credit on your Cash Passport account. For Cash Passport, the cashback processed will depend on the currencies available on your card and the location of your purchase. Examples of how a rebate may be processed are: If the destination currency is listed as a currency into which you can load funds onto your Card, the rebate will be credited as a single amount to the destination currency regardless of whether you have any funds available in that currency; or If the destination currency is not listed as a currency into which you can load funds onto your Card, the rebate will be credited to the local currency in the country in which your Prepaid Card was issued, i.e. AUD.