Earn Qantas Points and enjoy a wide range of benefits.

Three reasons to get a Qantas Platinum Credit Card

Qantas points

Earn 0.6 Qantas points per dollar spent, capped at 20,000 per statement period.2

Platinum travel perks

Up to 3 consecutive months international travel insurance (for persons under 81 years).7

Security

24/7 fraud monitoring and no liability for unauthorised transactions.5

Qantas Platinum summary

- Earn 0.6 Qantas points per dollar spent, capped at 20,000 per statement period2

- Free Qantas Frequent Flyer membership

- Up to 3 consecutive months international travel insurance (for persons under 81 years)7

- Extend warranty on covered purchases made with your credit card7

- 90 day purchase protection on stolen, accidentally damaged purchases when the total cost of the purchase is charged to your participating credit card7

- No fee for additional cardholders

- 24/7 fraud monitoring and no liability for unauthorised transactions5

- Up to 55 days interest free4

- Use everywhere Mastercard is accepted

- Access Mastercard Priceless® Cities exclusive experiences and special offers

- Mobile payments with your smart phone and smart watch

Check my eligibility

1. Your status

-

I'm an individual, not a company

-

I'm 18+ years of age

-

I'm not currently bankrupt or insolvent

-

I’m looking for a credit card for personal use, not business use

-

I’m applying for a credit card in my name only

2. Your residency

-

I'm an Australian citizen or permanent resident who is living/working in Australia.

-

I'm the holder of one of the following acceptable visa subclasses and have applied for permanent Australian residency and have a minimum of 12 months remaining on my visa: 188, 489, 491, 494, 482 (excluding short term stream)

3. Your income

-

I receive a regular income from one of the following accepted sources:

-

- PAYG (Permanent, non-permanent and casual employment)

- Managed superannuation

- Self-managed superannuation

- Self employed

Rates and fees

Annual fee

$149 p.a.

Purchase interest rate

19.99% p.a.

Balance transfer rate

21.99% p.a.

Cash advance rate

21.99% p.a.

Minimum credit limit

$3,000

Additional card holders fee

$0

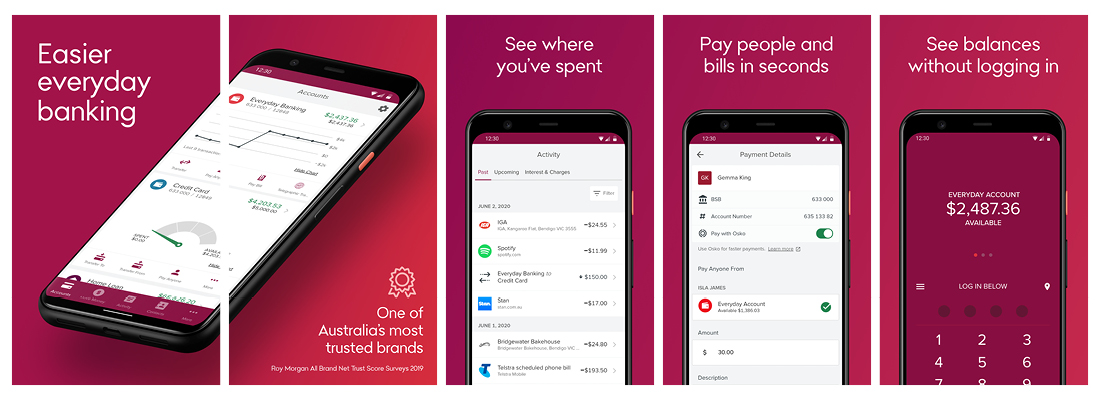

Discover the Bendigo Bank app

- Log in quickly and securely with biometric authentication or a Four-digit PIN

- See balances without logging in using Quick Balances

- Pay people and bills in seconds with PayID®, Osko, BPAY

- Add your debit or credit card to Apple Pay or Google Pay from the app

- Card controls at your fingertips

- Safe and secure 24/7

Download the Bendigo Bank app now:

Get the Qantas Platinum Credit Card

New customers

If you are a new customer you can apply online in minutes

Existing customers

If you are an existing customer, you can apply via e-banking.

Apply in branch

If you are a new customer you can apply at your preferred branch.

Helpful tools

Use our helpful tools to help compare and selected the right credit card for you.

Need help?

Online resources

We’ve got contact information and helpful resources to help you find the answers you need.

At a branch

Use our branch locator to search for a branch, agency or ATM near you.

Phone

If you have clicked on any suspicious links and entered your e-banking details:

You may also be interested in

Things you should know

Terms, conditions, fees and charges apply. All information is correct as at 1 February 2023 and is subject to change. Full details available on application. Credit criteria apply. Credit provided by Bendigo and Adelaide Bank Limited ABN 11 068 049 178 Australian Credit Licence 237879.

Target Market Determinations for products are available.

5Mastercard Zero Liability: Conditions for protection apply, see mastercard.com.au/zero-liability

Apple and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.

PayID® is a registered trademark of NPP Australia Limited.