Enjoy an ongoing bonus variable rate up to 4.30% p.a.** on our Reward Saver account (2024 Mozo Experts Choice Award winner) when you meet our eligibility criteria.

Three reasons to open a Reward Saver Account

Savings simplified

This account earns you an ongoing bonus variable rate when you grow your balance every month

Ongoing bonus variable interest rate

Ongoing attractive bonus variable interest rate of 4.30% p.a.

No monthly service fee

Watch your savings grow without worrying about monthly service fees

A high interest savings account helps you save for the future

Always get

UNLOCK up to

Learn how to earn the bonus rate

Set up a savings plan. Have a think about what you're saving for and how long you want to save. It will also help you continue to grow your balance so you're more likely to receive your bonus rate each month. You'll be right on track to reach your goal.

Make a deposit

Make at least one deposit in your Reward Saver account before the end of each month.

Withdraw less

Keep your withdrawals during the month less than the deposits you make.

Increase your balance

Make sure your end of month balance is greater than the start of month balance (in addition to interest paid by us).2

Handy tip: set up an automatic transfer from your transaction account to your Reward Saver on a weekly, fortnightly or monthly basis.

Reward Saver Account summary

- Minimum opening balance of just $1

- e-banking and phone banking anywhere, anytime

- No card access but transact online via e-banking, the Bendigo Bank app or through phone banking

- Grow your balance by earning a bonus rate

- Whether you are 30 years old or under3, or 31 years old and over3, you can currently enjoy the same bonus rate

- Go green with e-statements for your account

- Expert choice award 2024 - Mozo

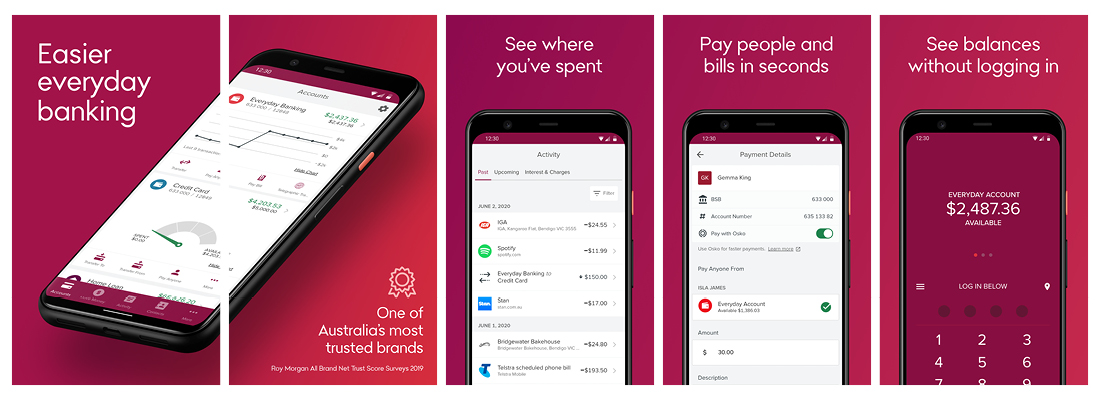

Banking made easy - try the Bendigo Bank app

- Log in quickly and securely with biometric authentication or a Four-digit PIN

- See balances without logging in using Quick Balances

- Pay people and bills in seconds with PayID®, Osko, BPAY

- Add your debit or credit card to Apple Pay or Google Pay from the app

- Card controls at your fingertips

- Safe and secure 24/7

Download the Bendigo Bank app now:

Rates and fees

Monthly service fees

$0

Branch & ATM

Bendigo Bank ATM and branch withdrawals not available. Deposits are free

Withdrawals

Free e-banking withdrawals. Branch withdrawals not available.

Interest rate

- 4.30% p.a. on balances up to $100,000

- Current base interest rate is 0.10% p.a.**

Interest calculated daily and paid monthly.

Before you start

Identity

If you are a new customer, we will need to verify your identity via any two forms of IDs listed below:

- Driver's licence

- Passport

- Medicare card

Eligibility

You need to be an Australian citizen or resident in order to apply for an Reward Saver Account.

Joint or business accounts

Not available to business customers. Please visit a branch to open a joint account.

Open a Reward Saver Account

New customers

If you are a new customer you can open at your preferred branch.

Existing customers

If you are an existing customer you can apply via e-banking.

Contact us

If you’d like more information you can contact us on 1300 236 344.

Helpful tools

Discover our library of helpful tools to manage your savings, set goals, and achieve more.

Need help?

Online resources

We’ve got contact information and helpful resources to help you find the answers you need.

At a branch

Use our branch locator to search for a branch, agency or ATM near you.

Phone

If you have clicked on any suspicious links and entered your e-banking details:

You may also be interested in

Things you should know

** All information is correct as of 28 June 2024, information including rate is subject to change.

1. You can only open one account held in either your name only or in joint names that will be eligible for the bonus rate. Any additional accounts opened will receive the base rate.

2. Your base or bonus interest will be credited to your account by the end of the 2nd day of the month.

3. For existing accounts, the interest rate will change on the first day of the month following your 31st birthday.

This information is of a general nature and does not take your personal objectives, financial situations or needs into account. You should consider its appropriateness to your circumstances before acting on this information. Please read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Please also review our Financial Services Guide (FSG) before accessing information on this website. Information on this page can change without notice to you.

This product is issued by Bendigo and Adelaide Bank Limited ABN 11 068 049 178 AFSL No 237879. Terms, conditions, fees and charges apply. All information is correct as at 27 October 2021 and is subject to change. Full details available on application.

Target Market Determinations for products are available.

Apple and Apple Pay are trademarks of Apple Inc., registered in the U.S. and other countries.

Google Pay is a trademark of Google LLC.

PayID® is a registered trademark of NPP Australia Limited.

Reward Saver Account

A high interest savings account