Bank your own way with the right transaction account to manage your money.

Compare award winning transaction accounts

Maximise your financial gains with our savings accounts. Enjoy competitive rates, easy access, and the confidence that your savings are secure.

- Most trusted brand (Highly recommended)

- Best customer service (Highly recommended)

Compare transaction accounts

Open an Everyday Account

-

$0 monthly account fee

-

24/7 fraud monitoring to detect and verify suspected transactions

-

All in one transaction account designed to help you manage your money

Looking for something specific?

Transaction account features

- A range of flexible bank accounts

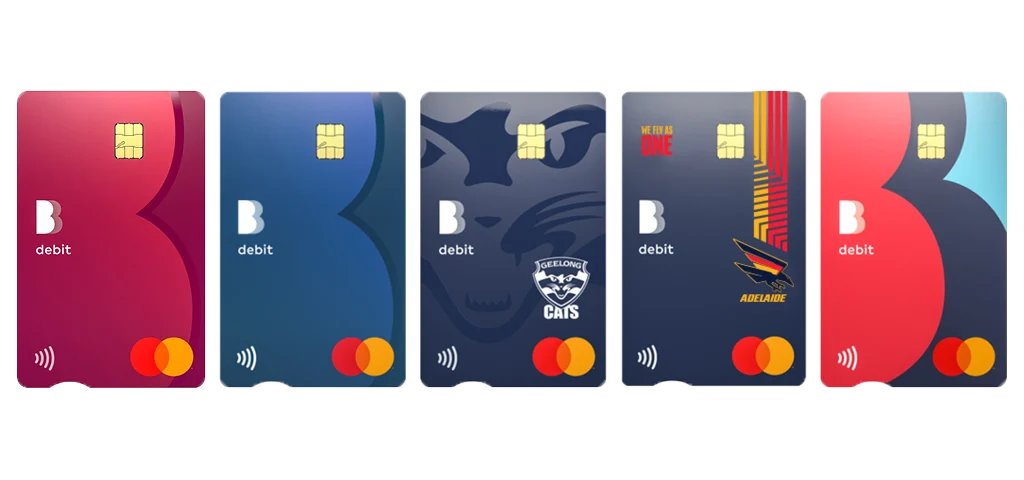

- Easy access to your money with a Debit Mastercard®

- Access your account via e-banking or the Bendigo Bank app

- e-statements for easy account management

- Mobile payments with your smart phone and watch

Debit card designs

Why bank with Bendigo Bank?

The better big bank

- Caring for millions of customers

- Award-winning Australian bank

- Profits invested back into Australian communities

- Community bank branches in rural areas

Security

- 24/7 fraud monitoring

- Multi-factor authentication

- Secure online shopping

- Zero Liability Protection5

- Banking safely online support

Bendigo Bank app

- Transfer money

- BPAY

- Lock/unlock lost cards

- Change your card PIN

Switch to Bendigo Bank

Make the switch that matters. Manage your finances with ease and get help when you need it from our award-winning bank.

Helpful tools

Discover our library of helpful tools to manage your finances, set goals, and achieve more.

Need help?

Online resources

We’ve got contact information and helpful resources to help you find the answers you need.

At a branch

Use our branch locator to search for a branch, agency or ATM near you.

Phone

If you have clicked on any suspicious links and entered your e-banking details:

You may also be interested in

Things you should know

^ Roy Morgan Risk Monitor 2025. Customers of Bendigo and Adelaide Bank Limited.

#If you hold a home loan the fee will be waived each month provided the home loan is in use at least 2 days prior to the date the fee is charged.

5Mastercard Zero Liability: Conditions for protection apply, see mastercard.com.au/zero-liability

This information does not take your personal objectives, financial situations or needs into account. You should consider its appropriateness to your circumstances before acting on this information. Please read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Please also review our Financial Services Guide (FSG) before accessing information on this website. Information on this page can change without notice to you.