The tools you need to master the fundamentals of the BID platform.

Learning modules

- Introduction to investing

- Creating your strategy

- Fundamental analysis

- Technical analysis

- Using derivatives

- Our trading platform

- Advanced strategies

Tutorials

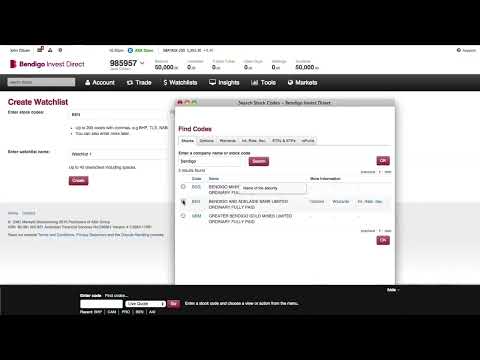

Learn how to use our platform with these quick learn video tutorials.

Guides, documents and forms to help you get started

Getting started in shares

Master the fundamentals of the share market and create a strategy with these handy easy to use guides.

Platform quick guide

Learn how to navigate the BID platform with our handy easy to use guide.

Downloads

Easily access all the necessary disclosure documents, applications, forms, and more for your BID account.

Haven’t found what you’re looking for?

You’ll find answers about our platforms, app, features and more in our frequently asked questions.

Frequently asked questions

When we’ve confirmed your ID, or you are electronically identified, we’ll process your application and open your account. This process is usually completed with 2-4 business days. You can then begin trading online and over the phone immediately (you’ll need funds and/or shares in your account to place orders).

Please note: The BID Cash Settlement Account balance is reported in real-time, while share transfers take longer to process.

Online orders

You need to have enough funds in your BID Cash Settlement Account. You can also trade online using a margin loan. More information can be found here.

Telephone orders

Please discuss payment with the dealer taking your order.

You can use a margin loan from any margin lending provider. If your margin loan is with Leveraged, you can enjoy a seamless fully integrated^ trading experience on the BID platform.

For more information about Leveraged margin lending products click here.

To link your existing margin loan account to your Bendigo Invest Direct account click here.

^ Executing Exchange Traded Options (ETOs) trades using a margin loan, is only available via phone.

If you have CHESS Sponsored holdings with another broker and would like to transfer them to Bendigo Invest Direct, the ‘Transfer Chess Holdings’ form will need to be completed. The completed form and a copy of your certified ID will need to be sent to scrip@bendigoinvestdirect.com.au.

Want to transfer issuer sponsored holdings? Navigate to the 'Account' menu, then 'Transfer Securities' on the BID Platform.

If you’d like to close your account please log into the web platform or mobile app and navigate to:

- Platform: Select Settings> Personal Details> Select ‘Request Account Closure' button.

- Mobile App: Select the information icon next to the account number you want to close> Select ‘Request Account Closure’ button.

If you're having trouble, please email (info@bendigoinvestdirect.com.au) , call (1300 788 982), or live chat with our client services team.

An account closure request can be submitted by an account owner when the following criteria are met:

- There are no open positions (Trades/Options) present on the account - please cancel or wait until trades/options are settled.

- There are no pending settlements present on the account - please wait until orders are settled.

- There are no Mfund holdings present on the account - please sell your Mfund holdings or make a request with your preferred broker to initiate a transfer of those holdings to that broker.

- There are no international holdings (non-AU holdings) present on the account - please sell your international holdings or make a request with your preferred broker to initiate a transfer of those holdings to that broker.

- If funds are present on your account, withdraw your funds or ensure an external bank account in a name that matches your account name is linked before the account closure request is submitted.

- If you close your account, we will not delete the user data or personal information we have collected about you in association with your account. All personal information will be retained in accordance with our Privacy Statements and Policies. To know about our data retention practices please view CMC Markets Stockbroking Privacy Statement and Bendigo Bank Privacy Policy.

Please note: The above instructions are for submitting an account closure request only. Your account will not be closed until Bendigo Invest Direct has accepted and processed the request. For faster processing, please ensure your account has no shares or holdings before placing this request.

It is also recommended that relevant account and trading statements are downloaded before placing a closure request. You will be notified via email once your account is closed.

All new and existing BID accounts with a linked cash account have this feature enabled.

Please note: international trading is not available to BID accounts that are funded by a margin loan.

Placing an international shares order is much like placing one for domestic shares.

Simply open an order ticket in the usual way, enter the stock code, select either ‘Buy’ or ‘Sell’ and fill in the required information. Just as you would for domestic stocks.

For further assistance, contact our Client Services support team online via live chat.

Our international shares offering gives you access to trade on major exchanges in 15 different countries, including: the USA, Canada, UK, Japan, Switzerland, Hong Kong, France, Belgium, Germany, NZ, Denmark, Singapore, Netherlands, Spain and, Sweden.

No, international shares are available and automatically enabled for all new and existing BID accounts with a linked cash account. Simply log in to the platform and search for an international stock.

The W-8BEN form is a legal document applicable to non-US residents who invest in US shares. It is required by the IRS (Internal Revenue Service) in order to declare your tax status.

If you do not complete the form, you may be subject to the US Treasury withholding tax on US investments held on your share trading account.

The W-8BEN allows foreign investors to claim special tax treaty benefits. This includes a reduced rate of withholding tax.

We offer an integrated online solution provided by Thomson Reuters that enables eligible account holders to complete and lodge a W-8BEN form.

Yes, BID provides four different forms through our platform. To lodge or update your US Tax form click on ‘Support’, then ‘US Tax Form’ and on the ‘US Tax Information’ page select ‘Update/Lodge Form’ to complete the relevant form.

Depending on your account type and your responses to initial questions, online processes will automatically select the appropriate form:

- W-8BEN – to be completed by individuals. A separate form is required for each account owner in the case of joint accounts

- W-8BEN-E – to be completed by a company, complex trusts (e.g. superfund accounts) where the recipient entity is the beneficial owner of the dividend

- W-8IMY – to be completed by entities where investment income is received in an intermediary capacity and is subsequently distributed to beneficiaries (e.g. Discretionary trusts)

- W-9 – to be completed by US Persons.

A custody fee is for:

- Holding your international shares and maintaining a consolidated international portfolio on your behalf; and

- Issuing distributions that result from mandatory corporate action events for your shares (such as dividends and bonus issues); and

- Providing statements that reflect these events.

A fee of 0.50% p.a., minimum $10 is applied monthly based on your foreign asset holdings value excluding cash. This fee may be waived if you have placed a trade on International Securities in the previous 12 months.

This number can vary across different markets. If an order is unacceptable to the relevant exchange, you will be notified that the order hasn’t been accepted.

The minimum transfer amount for international shares is AU$10,000.

If you currently hold international shares with another broker, we can transfer those shares to your BID account if the value of the shares are over AU$10,000.

The 2% Foreign Exchange (FX) buffer is not an additional fee.

The buffer acts as a cushion against currency movements ensuring there are sufficient available funds in your account to fill your order. When your order fills, excess funds are automatically added back to your ‘available funds’ value on the platform. Buffer funds are not withdrawn from your settlement account, but only locked in the ‘available funds’ calculation until your order has filled.

The buffer only applies to ‘buy’ orders.

Impact

For international buy orders, a 2% FX buffer is added to the trade value at the time the order is placed. This ensures you have sufficient funds in your account to cover any foreign exchange fluctuations between the time your order is ‘placed’ and when it is ‘filled’ on the international market.

Any excess buffer will be unlocked on the execution or cancellation of that order.

The FX conversion rate is determined as the order fills on the overseas stock exchange in real-time.

Please note: The FX buffer currently applied to international buy orders is 2% of the trade value and is subject to change.

The exchange rate for international transactions is calculated at the time of execution. It’s based on the best available bid/offer exchange rates, plus a spread of up to 0.70% of the FX Rate.1

| Exchange | Code | Local time at exchange |

|---|---|---|

| Hong Kong Stock Exchange | HKEX | 12.00 - 13.00 |

| Singapore Exchange | SGX | 12.00 - 13.00 |

| Tokyo Stock Exchange | TSE | 11.30 - 12.30 |

For Apple devices we support iOS 15.6 and above. For Android devices, the minimum OS version is 7.0 and above.

If enabled on your phone there will be a prompt to set Biometrics on your first login. You can also enable this feature at any time by tapping on the ‘More’ menu and then ‘Settings and Security’. Experiences may differ depending on your mobile operating system.

You must not enable Fingerprint or Face ID login where another person’s fingerprints/Face ID are registered on your mobile device. This is because they will be able to access your trading account and you will be responsible if they place any orders using the app. You can turn this feature off at any time via ‘Settings and Security’.

You can manage your Dynamic (automatic refresh)/Live (click to refresh) data settings via the web platform. Once setup, your preference will automatically flow through to your mobile app.

Yes. Full Market Depth is available on the mobile Stock Summary pages for ASX stocks and within the Order Ticket. Data refresh rate depends on the market data package you have chosen, i.e. Dynamic, or Click to Refresh.

Yes. You can login to your Desktop and Mobile App at the same time.

Each time you qualify for a new level for the first time, you will receive an alert on the BID platform and an email.

Every other time you change levels, you will only receive an email.

If you qualify for the Premium or Platinum level – a badge will appear beside your account. Black indicates Platinum and red indicates Premium.

You will qualify for the benefits based on the levels in which your trading accounts fall. Your highest levelled trading account (classic, premium, platinum) will determine the benefits to which you are entitled. Some benefits will require you to opt-in.

For Sharesight you will need to opt-in to create a Sharesight portfolio. You can do so via the Tax and Portfolio reporting page on the platform.

For live or dynamic market data, you’ll need to opt-in by subscribing to a market data package via the full site. To do this, hover over the settings cogwheel in the top left hand corner of your screen, click on “Market Data” and follow the prompts.

All invoicing for data is done in arrears, so in months where you qualify for free data, you will not be charged.

If you have an account which is trading 10 or more times per month, you are entitled to benefits other than free market data.

Trade 35 or more times per month (on one account) to gain complimentary access to a package from Sharesight, our tax and portfolio reporting partner, for up to 3 portfolios. You’ll also be entitled to research reports from theScreener.

Some benefits require you to opt-in, see below for more information.

No. Each account is classified by its own trading activity, and excess trades will not roll over to the following month.

Yes, if you generate at least $200 in brokerage you will be eligible for the Premium level. If you generate at least $600 in brokerage you will be eligible for the Platinum level.

Algorithmic trading or ’algo trading‘ is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume.

Volume-weighted average price (VWAP)

This strategy balances execution with the expected trade volumes over a specified time period.

Example: A VWAP order may buy or sell a greater volume in the first and last hour of trade as there are typically more market transactions during these periods.

Time-weighted average price (TWAP)

This is a strategy of executing trades evenly over a specified time period. It is typically used for the execution of large orders while minimising the impact on the market price.

Target Open

This is a strategy that targets participation in the ASX Opening Price Auction up to a defined limit price. If there is an unexecuted volume on the order after the ASX Opening Price Auction, the strategy will attempt to execute the balance of the order up to your limit price whilst minimising market impact.

Target Close

This is a strategy that targets participation in the ASX Closing Price Auction up to a defined limit price. This strategy may also execute part of its volume prior to the ASX Closing Price Auction if it is determined that this is required to minimise market impact for the ASX Closing Price Auction.

You will first need to agree to the terms & conditions of algorithmic trading by logging in to your trading account. Then you can select ‘Trade Settings’ from the ‘Settings’ menu option that is located on the top right-hand corner of your screen.

Alternatively, you can access this directly from the share purchase order ticket under ’Instruction’.

The fee for using algorithmic trading is 0.033% (inc. GST) and is based on the traded value of the algorithmic order. It will not be charged until the algorithmic order has executed. It’s important to note that the fee amount will be reflected on your ‘available to trade’ balance based on your order value. The fee will appear on your trade confirmation under ’Other Fees’ and added to the total cost for buys and deducted from the total return for sell trades. For full fees and costs, read the Financial Services Guide for Bendigo Invest Direct.

Yes, algorithmic trading is available to you on both Bendigo Invest Direct platforms on desktop only.

Algorithmic trading can only be used to place orders on the top 200 ASX-listed stocks.

Please refer to the Quick Guide, section 5 Algorithmic Trading, to learn more about how to place an order using algorithmic trading.

Helpful links

Dedicated customer support

Our team is available Monday to Friday (excl. public holidays). You can connect with us online via email and live chat from 7:30am – 7:00pm AEST/AEDT, or by phone from 7:30am – 5:30pm AEST/AEDT.

Online

Complete the online enquiry form and our team will be in touch.

Phone

Our dedicated customer support team are here to help.

You may also be interested in

Things you should know

Bendigo Invest Direct is a service provided by CMC Markets Stockbroking Limited ABN 69 081 002 851 AFSL No. 246381 (“CMC Markets Stockbroking”), a Participant of the ASX Group (Australian Securities Exchange), SSX (Sydney Stock Exchange) and Cboe (previously known as Chi-X) at the request of Bendigo and Adelaide Bank Ltd (ABN 11 068 049 178, AFSL 237879) (“Bendigo"). For a copy of the terms and conditions relating to the Bendigo Invest Direct services and the Financial Services Guides for CMC Markets Stockbroking or Bendigo (or other relevant disclosure documents), contact us on 1300 788 982, visit trading.bendigoinvestdirect.com.au/forms- external site or via email at info@bendigoinvestdirect.com.au. Neither CMC Markets Stockbroking nor Bendigo are representatives of each other. To the extent permitted by law, Bendigo will not guarantee or otherwise support CMC Markets Stockbroking’s obligations under the contracts or agreement connected with Bendigo Invest Direct.

Information is general advice only and doesn't take into account your personal objectives, financial situation, or needs. You should consider its appropriateness to your circumstances before acting on this information. Please read the disclosure documents for your selected product or service, including the Terms and Conditions, before deciding. Please also review our Financial Services Guide (FSG) before accessing information on this website. Information on this page can change without notice to you.

Gearing involves risk. It can magnify your returns; however, it may also magnify your losses.

The Leveraged Equities Margin Loan, Investment Funds Multiplier and Direct Investment Loan are issued by Leveraged Equities Limited (ABN 26 051 629 282, AFSL 360118) ("Lender") as Lender and as a subsidiary of Bendigo and Adelaide Bank Limited (ABN 11 068 049 178 AFSL 237879) ("Bendigo"). The Lender and Bendigo receive remuneration on the issue of the product or service they provide. Investments in this product are not deposits with, guaranteed by, or liabilities of Bendigo nor any of its related entities.